On April 2, 2020, the Department of Treasury and the Small Business Administration (SBA) posted the Interim Final Rule implementing Sections 1102 and 1106 of the CARES Act in advance of its publication in the Federal Register. On April 3, 2020, SBA also released an overhauled Paycheck Protection Program loan application form.

The new Interim Final Rule and SBA Form 2483 reflect significant developments since the promulgation of the CARES Act and our prior guidance. Updates based on these developments are included below in red text for ease of reference.

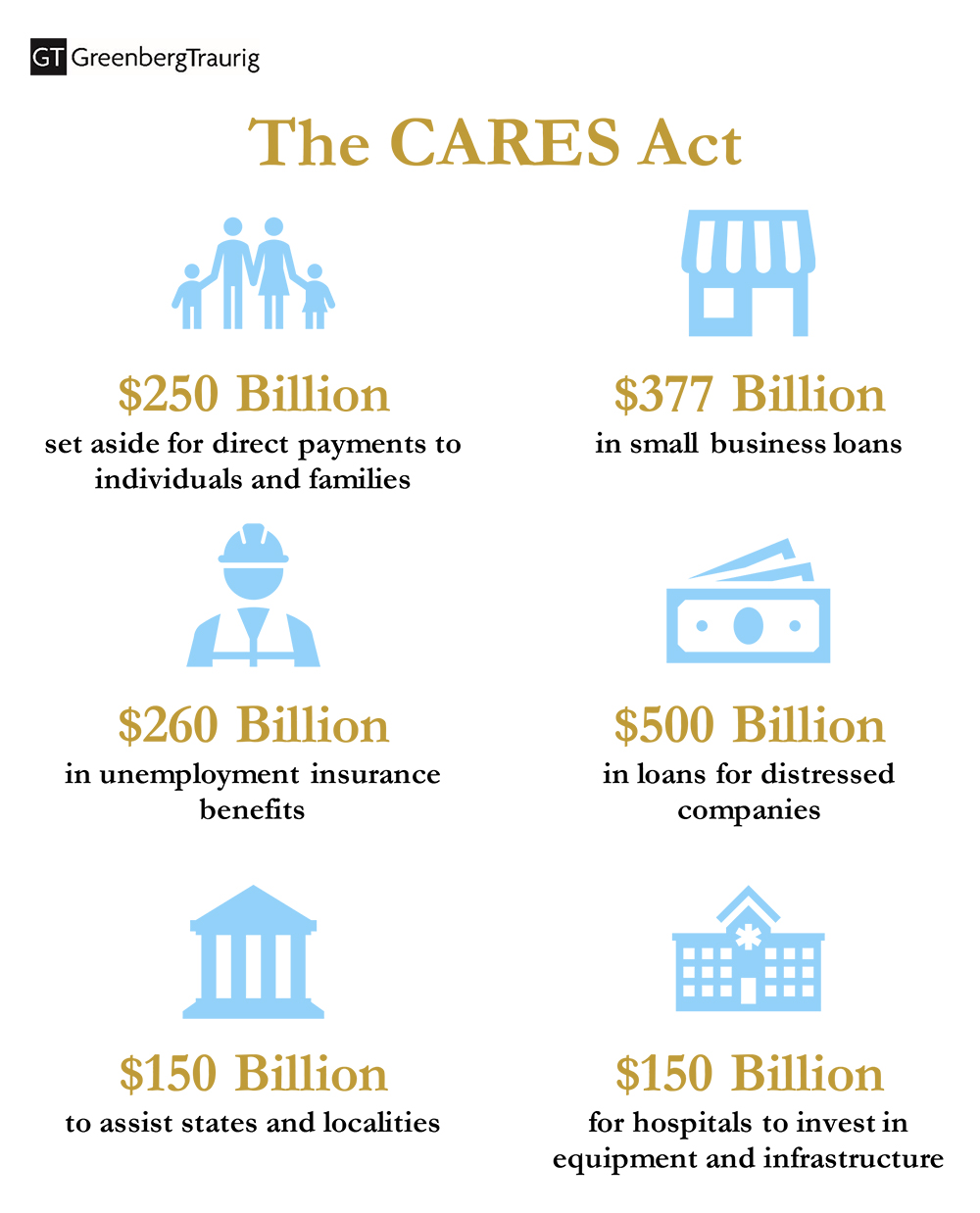

In the midst of a global pandemic and the highest unemployment rates the United States has seen since 1933, President Trump signed into law the $2 trillion Coronavirus Aid, Relief and Economic Security Act (the “CARES Act”), providing economic relief to businesses, States and municipalities, and individuals affected by COVID-19. While the scope of the CARES Act is wide-ranging, this alert is limited to providing a high-level overview of the relief available for qualifying business concerns (generally small businesses with certain limited exceptions). We will publish additional alerts as the SBA issues implementing regulations over the next 15 days.

Which businesses will be eligible for relief under the CARES Act?

Under Title I of the CARES Act (“Keeping American Workers Employed and Paid”), qualifying businesses that have suffered significant disruption as a result of COVID-19 will be able to receive no-fee “small business interruption loans.” Qualifying small businesses include “any business concern, nonprofit organization, veteran’s organization, religious organizations or Tribal business” that have:

- 500 employees or fewer, whether employed on a full-time, part-time, or other basis; or

- meet the SBA’s industry-based “size standard” requirements for the applicable North American Industry Classification System (NAICS) code, which are based either on number of employees or annual receipts, if larger than 500 employees, in which the concern operates.[1]

The Interim Final Rule clarifies that only concerns that “either had employees for whom you paid salaries and payroll taxes or paid independent contractors, as reported on a Form 1099-MISC,” are eligible for PPP loans, and that “no eligible borrower may receive more than one PPP loan.”

SBA Form 2483 indicates that applicants will not be eligible to receive loans if the Applicants or their owners: are presently or are proposed for suspension or debarment, presently involved in any bankruptcy, delinquent or in default on any direct or guaranteed loan by a Federal agency, or subject to formal criminal charges or probation; or that have within the past 5 years been convicted of any felony or placed on parole or probation.

What are the exceptions to the “500 employees” rule? How do the SBA’s affiliation rules come into play?

The updated SBA Form 2483 requires applicants to certify that the “Applicant is eligible to receive a loan under the rules in effect at the time this application is submitted that have been issued by the [SBA] implementing the Paycheck Protection Program.” The Interim Final Rule states that “SBA intends to promptly issue additional guidance with regard to the applicability of affiliation rules at 13 CFR §§ 121.103 and 121.301 to the PPP loans.”

To determine an applicant’s receipts or number of employees, each applicant can generally expect that it must aggregate all employees on an affiliate basis, including subsidiaries and, in the context of private equity-backed and venture capital-backed businesses, portfolio companies. Exceptions are made in the legislation for:

- independently owned franchises,[2] who are approved by the SBA, and hospitality businesses that fall within NAICS code 72, “Accommodation and Food Services,” and each of location with 500 or fewer employees; and

- any business receiving financial assistance from a Small Business Investment Company (“SBIC”).

What about independent contractor or gig economy workers?

Yes, sole proprietors, independent contractors, gig economy workers, and self-employed individuals are all eligible for the Paycheck Protection Program.

The Interim Final Rule clarifies “independent contractors” do not count as employees “for purposes of a borrower’s PPP loan calculation,” or “PPP loan forgiveness,” because “independent contractors have the ability to apply for a PPP loan.”

Who will provide and administer the loans?

Loans will be administered pursuant to SBA’s section 7(a) loan program, as modified by the CARES Act. Loans will be made and serviced by existing banks and lenders enrolled in the SBA 7(a) program, as well as any other lenders determined by the SBA “to have the necessary qualifications to process, close, disburse and service loans made with the guarantee of the Administration.”

What is the maximum loan size?

The CARES Act sets the maximum loan amount under the Paycheck Protection Program as 250 percent of average monthly payroll costs, up to a total of $10 million. The amount is intended to cover eight weeks of payroll expenses and any additional amounts for making payments towards debt obligations. This eight-week period may be applied to any time frame between February 15, 2020 and June 30, 2020. Seasonal business expenses will be measured using a 12-week period beginning February 15, 2019, or March 1, 2019, whichever the seasonal employer chooses.

The Interim Final Rule clarifies that the maximum loan amount should be calculated based on the applicant’s “[a]ggregate payroll costs . . . from the last twelve months for employees whose principal place of residence is the United States,” less “any compensation paid to an employee in excess of an annual salary of $100,000.”

The Interim Final Rule further clarifies that the “outstanding amount of an Economic Injury Disaster Loan (EIDL) made between January 31, 2020 and April 3, 2020, less the amount of any ‘advance’ under an EIDL COVID 19 loan,” may be included in the maximum loan amount for PPP loans.

The terms of the loan may differ on a case-by-case basis. However, the maximum terms of the loan can be up to ten years with an interest rate capped at 4% per annum and there shall be no prepayment penalties. The SBA will also reimburse lenders for origination or underwriting fees in an amount of: (i) 5% for loans of not more than $350,000, (ii) 3% for loans of more than $350,000 and less than $2 million and (iii) 1% for loans equal to or greater than $2 million. The SBA will issue additional regulations and guidance with respect to other terms and conditions of the program.

The Interim Final rule clarifies that the interest rate “will be 100 basis points or one percent,” and that the “maturity is two years,” for PPP loans. The Interim Final Rule further clarifies that “there will be no up-front guarantee fee payable to the SBA by the Borrower,” and that “Agent fees will be paid by the lender out of the fees the lender receives from SBA.”

Any other restrictions on loan terms?

Yes, the CARES Act limits the use of Paycheck Protection Program loans to: (1) payroll costs, excluding the prorated portion of any compensation above $100,000 per year for any person; (2) costs related to the continuation of group health care benefits during periods of paid sick, medical, or family leave, and insurance premiums; (3) employee salaries, commissions, or similar compensations; (4) payments of interest on any mortgage obligation that existed on February 15, 2020 (which shall not include any prepayment of or payment of principal on a mortgage obligation); (5) rent payments (including rent under a lease agreement); (6) interest on any other debt obligations that were incurred before February 15, 2020; and (7) utility payments, including electricity, gas, water, transportation, and phone and Internet access for service incurred in the ordinary course of business prior to February 15, 2020, in each case, paid during the eight-week period commencing on the date of origination of the loan.

The Interim Final Rule clarifies that “Payroll costs” shall not include “Federal employment taxes imposed or withheld,” “including the employee’s and employer’s share of FICA (Federal Insurance Contribution Act) and Railroad Retirement Act taxes,” “income taxes required to be withheld from employees,” and “qualified sick and family leave wages for which a credit is allowed under sections 7001 and 7003 of the Families First Coronavirus Response Act.”

In addition, the Interim Final Rule further clarifies that if a borrower uses “PPP funds for unauthorized purposes, SBA will direct [the borrower] to repay those amounts,” and that borrowers that “knowingly” misuse the funds “will be subject to additional liability such as charges of fraud.”

Will interest payments be deferred for any period?

Yes, loan payments (including principal, interest and fees) will be deferred for at least six months and up to one year starting at the origination of the loan.

The Interim Final Rule clarifies the deferment period will be for 6 months “following the date of the disbursement of the loan,” and that while borrowers will not have to make any interest payments during the deferment period, “interest will continue to accrue on PPP loans during this six-month deferment.”

What portion of the loans will be eligible for forgiveness?

The loan will be eligible for forgiveness to the extent that the loan proceeds have been used for the following costs incurred and payments made during the eight-week period after the loan is made: (1) payroll costs, excluding the prorated portion of any compensation above $100,000 per year for any person; (2) group healthcare benefits and insurance premiums; (3) mortgage interest (but not on any prepayment of or payment of principal on a covered mortgage obligation); (4) rent payments and leases in existence prior to February 15, 2020, and; (5) certain utility payments, including electricity, gas, water, transportation, and phone and Internet access for service incurred in the ordinary course of business prior to February 15, 2020, in each case, paid during the eight-week period commencing on the date of origination of the loan. The Paycheck Protection Program can be used for other business-related expenses, like inventory, but that portion will not be forgiven.

The Interim Final Rule clarifies that the amount of loan forgiveness can be up to the full principal amount of the loan and any accrued interest, and that “not more than 25 percent of the loan forgiveness amount may be attributable to non-payroll costs.”

The Interim Final Rule states that “SBA will issue additional guidance on loan forgiveness.”

A borrower will be required to submit a detailed application in support of loan forgiveness directly to the lender (see chart here). The lender will make a determination on the application within 60 days of receipt of the application; the loan is forgiven at the end of the 8-week period after the borrower takes the loan. Borrowers will work with lenders to verify covered expenses and the proper amount of forgiveness. The SBA will reimburse the lender directly for the principal amount of any forgiven debt, plus interest accrued through the date of repayment. SBA will issue additional implementation guidance and regulations regarding the loan forgiveness process within 30 days after enactment of the CARES Act.

Forgiven amounts will not constitute cancellation of indebtedness income for federal tax purposes.

The Interim Final Rule clarifies that a “lender does not need to conduct any verification if the borrower submits documentation supporting its request for loan forgiveness and attests that it has accurately verified the payments for eligible costs. The Administrator will hold harmless any lender that relies on such borrower documents and attestation from a borrower.”

What portions of the loan will not be eligible for forgiveness?

The purpose of the Paycheck Protection Program is to help businesses retain employees, at their current base pay. If all employees are retained at their current salary, the entirety of the loan will be forgiven. If employees are laid off, the forgiveness will be reduced by the percent decrease in the number of employees. If the borrower reduces the salary or wages of an employee no more than $100,000 per year by more than 25%, loan forgiveness will be reduced by the same amount. If borrowers make staff or covered salary reductions between February 15, 2020 and April 26, 2020, the loan can still be forgiven for the full amount of payroll costs if those reductions are eliminated by June 30, 2020.

Is the borrower responsible for interest on the forgiven loan amount?

No, if the full principal of the Paycheck Protection Program loan is forgiven, the borrower is not responsible for the interest accrued in the 8-week covered period. The remainder of the loan that is not forgiven will operate according to the loan terms agreed upon by the borrower and the lender.

What can the loans be used for? Are there any restrictions?

Payroll, rent, mortgage payments, utilities, sick leave, insurance benefits and healthcare premiums are among the permitted uses. Proceeds of loans may also be used to make interest payments on other debt obligations that were incurred prior to February 15, 2020. However, loan proceeds may not be used to make any payment or prepayment of principal of existing debt obligations (e.g., mortgages).

SBA Form 2483 requires applicants to certify that PPP loan “funds will be used to retain workers, maintain payroll or make mortgage interest payments, lease payments, and utility payments, as specified under the Paycheck Protection Program Rule.”

Will these loans be secured? Where would these loans rank in security and priority as compared to any pre-existing third-party debt instruments?

No, the loans will be unsecured and will not take precedence over existing debt instruments in terms of payment priority. The loans will also not require collateral or personal guarantees from owners of borrowers. There will be no recourse to owners or borrowers for nonpayment, except to the extent proceeds are used for an unauthorized purpose. The SBA has also waived prepayment penalties and has waived the guaranty fee and annual fee applicable to other 7(a) loans.

What is the deadline to apply to the program?

June 30, 2020.

The Interim Final Rule clarifies that the PPP loans will be available on a “first-come, first-served” basis through June 30, 2020, or “until funds made available for this purpose are exhausted.”

Will these loans trade on the secondary market?

Yes.

In addition, the Interim Final Rule clarifies that a “PPP loan may be sold on the secondary market after the loan is fully disbursed,” and that a “lender may request that the SBA purchase the expected forgiveness amount of a PPP loan or pool of PPP loans at the end of week seven of the covered period.”

Are the small business interruption loans the same as the small business “disaster” loans I have read about?

No, the “disaster” loans are relief in addition to the small business interruption loans. Under existing authority, the SBA will also provide smaller “Economic Injury Disaster Loans” (EIDLs) in an amount up to $2 million to businesses with not more than 500 employees, and agricultural cooperatives, that meet the SBA’s industry-specific business size limitations in declared disaster areas (a growing list of states) and have suffered substantial economic damage as a result of COVID-19 for the period of January 31, 2020 to December 31, 2020. Most private non-profit organizations, of any size, will also be eligible EIDL Loans.

Can I get a Paycheck Protection Act loan if I received an EIDL Loan?

Yes, if an EIDL loan was obtained related to COVID-19 between January 31, 2020 and the date at which the Paycheck Protection Program becomes available, borrowers will be able to refinance the EIDL into the Paycheck Protection Program for loan forgiveness purposes. However, borrowers may not take out an EIDL and a Paycheck Protection Program for the same purposes. Remaining portions of the EIDL, for purposes other than those laid out in loan forgiveness terms for a Paycheck Protection Program loan, would remain a loan. If a borrower took advantage of an emergency EIDL grant award of up to $10,000, that amount would be subtracted from the amount forgiven under Paycheck Protection Program.

The Interim Final Rule clarifies that borrowers that “received an SBA EIDL loan made between January 31, 2020 and April 3, 2020,” may “apply for a PPP loan.” If the EIDL loan was not used for payroll costs, the EIDL loan will not effect the borrower’s eligibility for a PPP loan. However, if the borrower’s EIDL loan was used for payroll costs, the borrower’s “PPP loan must be used to refinance [the] EIDL loan.”

Did the Care Act relax other EIDL Program Requirements?

Yes, the CARES Act also: (1) waives any requirement for a personal guarantee for loans that are less than $200,000; (2) replaces the requirement that eligible businesses be in business for the 1-year period before the disaster with a requirement that businesses must have been in operation on January 31, 2020, and; (3) waives requirement that applicants are unable to obtain credit elsewhere.

The Interim Final Rule clarifies that no collateral or personal guarantees by borrowers are required for PPP loans.

What about advances?

The CARES Act also allows businesses, that self-certify as eligible, to apply for an EIDL advance/ grant, in an amount up to $10,000, to be provided within 3 days after receipt of the application. Advances can be applied to any allowable purpose under the section 7(b) program, including: (1) providing paid sick leave to employees unable to work due to the direct effect of COVID–19; (2) maintaining payroll to retain employees during business disruptions or substantial slowdowns; (3) meeting increased costs to obtain materials unavailable from the applicant’s original source due to interrupted supply chains; (4) making rent or mortgage payments, and; (5) repaying obligations that cannot be met due to revenue losses. If an applicant that receives an advance is subsequently denied an EIDL loan, the advance does not need to be repaid. If an applicant receives an advance under the EIDL program and “transfers into, or is approved for, the loan program under” the 7(a) program, “the advance amount shall be reduced from the loan forgiveness amount for a loan for payroll costs made under such section 7(a). The CARES Act designates $10 billion for these immediate EIDL grants.

What about tax credits?

Certain employers will be eligible for a payroll tax credit in each applicable quarter in an amount equal to 50% of the first $10,000 of qualified wages paid to employees (including health benefits) between March 13, 2020 and December 31, 2020. However, this credit is not available to employers who participate in the Paycheck Protection Program. This credit will be available to employers whose business (i) was fully or partially suspended due to a government shutdown order or (ii) experienced a decline of gross receipts of at least 50% vs. the same calendar quarter in the prior year (until such time as gross receipts for a quarter are greater than 80% vs. the same calendar quarter in the prior year). For businesses with greater than 100 full-time employees, the tax credit is only available to the extent wages are paid to employees who are unable to work as a result of a government shutdown order. For businesses with fewer than 100 full-time employees, the tax credit is available for all employees, even if the employee works from home during the business closure. This relief is set forth in Title II (Section 2301) rather than Title I of the CARES Act. Because this 50% tax credit FOR wages paid is not available to employers who participate in the Paycheck Protection Program, an employer would need to choose between taking this credit or obtaining a loan under the Paycheck Protection Program.

Where can I apply for the Paycheck Protection Program?

Businesses can apply for the Paycheck Protection Program at any lending institution that is approved to participate in the program through the existing SBA 7(a) lending program and additional lenders approved by the Department of Treasury. There are thousands of banks that already participate in the SBA’s lending programs, including numerous community banks. You do not have to visit any government institution to apply for the program. You can call your bank or find SBA-approved lenders in your area through SBA’s online Lender Match tool.[3]

The Interim Final Rule clarifies that (i) “[a]ny federally insured depository institution or any federally insured credit union,” (ii) certain “Farm Credit System institution[s],” and (iii) certain “depository or non-depository financing” providers meeting specifically enumerated requirements “will be automatically qualified” to issue PPP loans unless currently designated as in Troubled Condition or subject to a formal enforcement action by their primary federal regulator.

For a detailed overview of the loan options available under the CARES Act, see our chart.

For more information and updates on the developing situation, visit GT’s Health Emergency Preparedness Task Force: Coronavirus Disease 2019.

*Special thanks to Steven M. Felsenstein, Barbara A. Jones, Peter Lieberman, Michael J. Schaengold, Scott Schipma, Brittany E. Allison, Brett Castellat, Danielle K. Muenzfeld, and Caroline E. Thee‡ for their assistance with this Alert.

‡Admitted in Indiana. Not admitted in Illinois.

[1] Small business size standards vary by industry and are generally based on the number of employees or the amount of annual receipts the business has. Small business size regulations can be found in Title 13 Part 121 of the Electronic Code of Federal Regulations (eCFR).

[2] Eligible franchises van be found through the SBA’s Franchise Directory

[3] https://www.sba.gov/funding-programs/loans/lender-match.