Introduction to Qualified Opportunity Zones

The new tax reform legislation, the Tax Cuts and Jobs Act (TCJA), created a significant new economic development tool alongside a meaningful tax deferral and abatement mechanism, “qualified opportunity zones.” The new provision provides a flexible deferral mechanism for short and long term capital gains for current investments in nearly all asset classes. Unlike Section 1031 “like-kind” deferral, qualified opportunity zones will provide: (i) the ability to invest only the gain rather than the full corpus of a current investment, (ii) a broader range of investments eligible for the deferral, (iii) a potential basis step-up of 15 percent or substantially more of the initial deferred amount of investment, and (iv) an opportunity to abate all taxation on capital gains post-investment. This program will provide businesses, projects, and commercial property in eligible low-income census tracts attractive financing and what could amount to a substantial long-term subsidy for economic development. The provision will also provide opportunities for investors, individual and corporate, to defer current capital gains, significantly increase basis in their current investments, and abate all future capital gains on the investment. Sophisticated fund managers should be able to find complex structures and entity planning to optimize return for investors and maximize subsidy for low-income businesses and property investment.

Business Tax Credit, Incentive Programs, and Capital Asset First Year Depreciation and Expensing

The TCJA preserves existing tax credit and tax credit incentive programs along with expansion of first year depreciation and expensing for purchase of capital assets. Importantly, the legislation also creates Qualified Opportunity Zones, a new incentive investment program with the intent to subsidize growing businesses in low-income communities through short term and long term capital gains tax deferral and the potential of significant basis step-up. Maintaining tax credit programs and growing immediate capital asset tax expensing is meant to incentivize economic growth and community impact in targeted sectors and across industries. Specifically, Congress intends to preserve incentives for affordable housing expansion, economic development investment in low-income communities, and development of specific renewable energy technologies, including solar and wind, as well as encouraging increased investment into capital assets, including equipment, for the expanded production of income.

While the reconciled tax legislation does not significantly change existing tax credit programs, ancillary impacts will arise through other revisions in tax policy through TCJA. Notably, the pricing of tax equity will be impacted through reduction of corporate rates, real estate investment provisions, and international repatriation provisions.

Qualified Opportunity Zones

TCJA legislation adopts an important and unheralded new tax incentive program proposed by Senator Tim Scott and Representative Pat Tiberi in the form of Qualified Opportunity Zones in a new Section 1400Z of the Internal Revenue Code of 1986, as amended (the Code). Due to the broad base of potential investors and eligible projects, property, and transactions, this program has the ability to provide substantial returns to investors, administrative opportunities for funds, and subsidy for eligible projects and businesses.

These “qualified opportunity zones” will be designated through a nomination of census tracts qualifying as “low-income communities” (as such term is defined under Section 45D of the Code for New Markets Tax Credits) by the governor of each state to the Treasury Department and certification of the zone by the Treasury Department. Each state may nominate no more than a number of “qualified opportunity zones” equal to 25 percent of designated “low-income communities” in each state. States may also nominate census tracts contiguous with “low-income communities” if the median family income in the designated census tract does not exceed 125 percent of the qualifying contiguous “low-income community.” The process for state designation will necessarily be political and likely include advocacy to draw the governor’s attention to the census tracts with the most economic development potential.

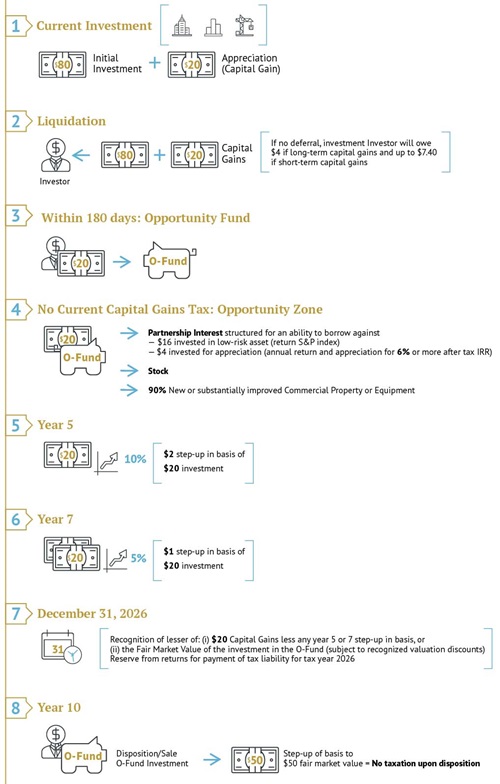

The new provision allows taxpayers to defer the short term or long term capital gains tax due upon a sale or disposition of property if the capital gain portion of the sale or disposition is reinvested within 180 days in a “qualified opportunity fund.” If the investment is maintained in the “qualified opportunity fund” for five years, the taxpayer will receive a step-up in tax basis equal to 10 percent of the original gain. If the investment is maintained in the “qualified opportunity fund” for seven years, the taxpayer will receive an additional five percent step-up in tax basis. A recognition event will occur on Dec. 31, 2026, in the amount of the lesser of (i) the remaining deferred gain (accounting for earned basis step-ups) or (ii) the fair market value of the investment in the “qualified opportunity fund.” Because of the recognition event trigger, several structuring opportunities may be available to increase basis step-up, substantially in some cases. Importantly, investments maintained for 10 years and until at least Dec. 31, 2026, will allow for an exclusion of all capital gains from post-acquisition gain on the investment in a “qualified opportunity fund” to be excluded from gross income. For an investment maintained longer than 10 years and upon a sale or disposition of the investment, the new provision also allows the taxpayer to elect the basis in the investment to be equal to the fair market value of the investment.

“Qualified opportunity funds” will be determined by the Community Development Institutions Fund of the Treasury Department in a process similar to allocation of New Markets Tax Credits to “community development entities.” The “qualified opportunity funds” must maintain at least 90 percent of assets in “qualified opportunity zone property,” including investments in “qualified opportunity zone stock,” “qualified opportunity zone partnership interest,” and “qualified opportunity zone business property.” The qualifications as “qualified opportunity zone stock,” “qualified opportunity zone partnership interest,” and “qualified opportunity zone business property” encompass investments in new or substantially improved tangible property, including commercial buildings, equipment, and multi-family complexes with a common requirement that such investments must be made in qualified opportunity zones.

This new tax incentive program will provide significant planning opportunities for many investors and is intended to generate additional long-term investment in areas most needing redevelopment and business growth. Qualified commercial property, businesses, and projects may use this new incentive as a low-cost subsidy for growth. This new legislative program has garnered little attention and may be a useful tool in capital gains deferral, particularly for individuals, funds, and companies considering investments in low-income communities. At worst, this incentive program will provide for a capital gains deferral mechanism for short term investments in a form more attractive than current Section 1031 “like kind” exchanges. Optimally, this program will provide for short and long term capital gains deferral, substantial step up in tax basis, and tax abatement of all post-investment appreciation.

Much guidance and regulatory clarification is expected in coming weeks and months to flesh out this nascent incentive program.

Qualified Opportunity Zone Investment Example:

New Markets Tax Credits

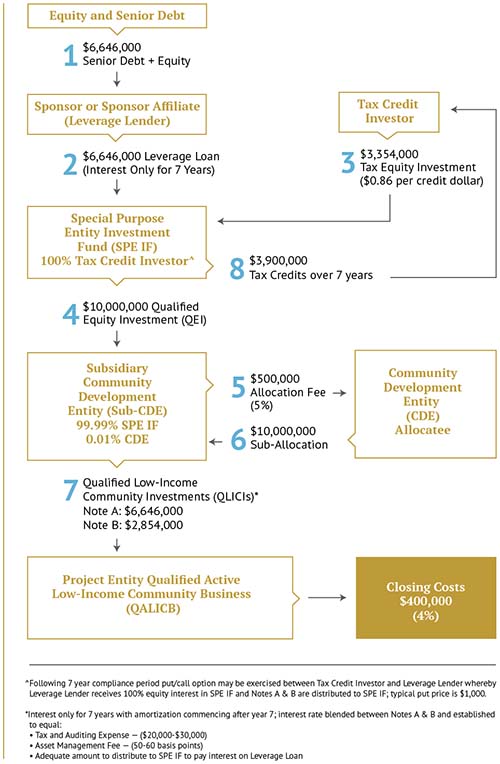

Financing enhanced by New Markets Tax Credits (NMTC) provides opportunities for businesses, developers, and not for profit organizations to expand, grow, and create economic stimulus and community impact. Projects financed through NMTC structures oftentimes realize a net benefit of 20 to 25 percent of eligible project costs. Eligible costs may include new buildings and resource facilities, capital expenditures, equipment, working capital, programmatic activities, and land acquisition. Use may include both for-profit and not-for-profit facilities and the facilities oftentimes utilize NMTC financing to close gaps in capital stacks for project completion. For example, a $10 million manufacturing plant project may net the company a benefit equaling $2 to $2.5 million after structuring and closing costs are paid.

Almost as important as the fulfillment of the last 20 to 25 percent financing gap critical for the success of many projects, sophisticated lenders familiar with NMTC financing view the NMTC benefit as “like equity” in a traditional loan to value analysis. Due to this substantial advantage vis a vis senior financing or equity, not for profits can enhance and “supercharge” capital campaigns and businesses and developers may require less equity for project completion.

The new $3.5 billion of allocation of NMTC for financing pending and new projects should be available in February or March 2018. The groups allocated these credits for use with some of the most impactful projects. Community Development Entities are currently evaluating and accepting review of highly qualified projects for this allocation round.

Greenberg Traurig works with clients in identifying opportunities where NMTC may benefit business expansion, real estate development, or a not for profit mission. We assist clients with structuring and closing projects with significant community impact so that the NMTC benefits the project and the outcomes in the lives of the surrounding community and its residents.

Overview

The purpose of the NMTC program is the provision of capital infusion through lending and equity contributions into qualifying low-income communities as determined via census tract or through provision of services to targeted populations. These communities and populations traditionally prove to be difficult to initiate lending or equity investment. Lenders may be motivated to make senior loans through utilization of NMTC both because of the risk ameliorated status of the borrower due to the transaction’s net benefit and because of the opportunity to obtain necessary credits for the financial institution as required under the Community Reinvestment Act. Through a 39 percent federal income tax credit available over a seven-year compliance period, tax credit investors effectuate capital investment and lending to qualified businesses and projects. Whereas traditional sources of capital may not flow into these low-income communities, the New Markets Tax Credit financings (NMTC financings) allow favorable terms and incentives to boost economic viability for operating businesses, real estate projects, and not for profit ventures serving these identified communities.

The federal NMTC program was adopted in 2000 in the Community Renewal Tax Relief Act of 2000 championed as a bipartisan effort. The first allocation of credits commenced with the 2002 allocation with initial credit investments taking place in 2003. Throughout its 15-year existence, the program continues to enjoy bipartisan support with program extensions on an annual or bi-annual basis with the latest five-year extension, the longest extension in program history, for $3.5 billion of allocation in each year found in the Protecting Americans from Tax Hikes Act of 2015. The applicable governing federal law is located in Section 45D of the Internal Revenue Code of 1986, as revised, and in Section 1.45D-1 of the Treasury Regulations. The United States Treasury Department through its Community Development Financial Institutions Fund (the CDFI Fund) manages and administers the federal NMTC program. The CDFI Fund allocates NMTC on an annual competitive basis to Community Development Entities (CDEs), private groups who provide loans or equity investments to the most impactful projects across the nation. The competitive nature of the allocation process to the Community Development Entities is passed on to projects wishing to benefit from NMTC as these CDEs are incentivized to allocate credits to the most impactful projects presenting significant community outcomes. One hundred twenty Community Development Entities were awarded allocation in the latest November 2015 allocation of $7 billion of NMTC.

Tax Reform Impact

This economic catalyst, job creation, and community development initiative for revitalization of low-income communities found in the NMTC program was preserved in its current state through the TCJA. House legislation proposed an elimination of the NMTC program following the current 2017 allocation of tax credit authority to private “community development entities” for placement in high community impact projects nationwide. Existing legislation allows for three more allocation rounds of tax credits and it has, throughout the program’s history, been subject to frequent tax extender legislation.

NMTC transactions are also subject to tax equity pricing adjustments because of corporate rate reductions. Under the reconciliation tax legislation, the pool of corporate taxpayers investing in NMTC transactions may be limited due to the tax credits’ ineligibility to offset the Base Erosion and Anti-abuse Tax (BEAT) in the reconciled bill, a minimum tax on foreign-owned corporations or corporations with substantial foreign operations. However, the elimination of the corporate Alternative Minimum Tax and increase in the individual thresholds for individual Alternative Minimum Tax could open the door for new investors in the NMTC space.

Pending legislation would make the NMTC program a permanent provision of the Code, but under current law, NMTC will have three more allocation rounds. Tax extender legislation often provides renewal, and permanency has been a continued goal for the program.

Qualification

In a typical NMTC transaction, the borrower does not utilize the NMTC against its own taxable liability. For this reason, for profit entities and not for profit organizations can benefit from NMTC financing regardless of whether the entity or organization may owe federal taxes.

Three primary factors weigh into project qualification and attraction of NMTC:

1. The primary threshold qualification criterion commences with an examination of the situs of a business or project. A qualified business or project should be located in a qualifying low-income community as determined by census tract data. It is preferable for a business or project to be located in or serve a severely distressed low-income community. Qualification and severe distress are measured by a census tract’s poverty rate, unemployment rate, and the comparison of residents’ income to area median income. If a census tract is qualified but not severely distressed using this primary criteria, it is possible the tract may still be severely distressed under an analysis of secondary criteria factors. Tests to ensure qualification of situs in a low-income census tract include evaluating the situs of gross assets and tangible personal property as well as the location of the services provided and employment of personnel for the business or project. We can assist in evaluating a project’s location and qualification, particularly if identification of secondary criteria is necessary.

2. Because of the broad assortment of uses of NMTC financing, the second factor for qualifying a project relies on prohibited and disqualifying uses. If the initial location threshold qualification is met, several disqualifying factors may still apply. First, a business or project cannot be operating as a “sin business” as provided in the following list:

- a private or commercial golf course;

- a country club;

- a massage parlor;

- a hot tub facility;

- a suntan facility;

- a racetrack;

- a gambling facility; or

- a liquor store.

Additionally, the business or project cannot be a farm (except in narrow qualifying circumstances) or be predominantly engaged in the development or holding of intangibles for sale or purchase. Importantly, NMTC financing is limited to businesses or projects where no more than 80 percent of gross revenue is derived from income from residential rental housing. Mixed use and multi-use projects may be permissible, but projects must include a substantial non-residential component. Structuring may be available to delineate residential rental housing from commercial uses. Temporary or transient housing does not apply against this restriction, and in many cases where both housing and services are provided, an analysis of the market value of each component can lead to successful transaction structures. The NMTC program places restrictions upon the amounts of collectibles or cash (or cash equivalents) a business or project may retain. Professional structuring is usually required in order to meet many of these qualification requirements.

3. The most important factor for attraction of NMTC relates to a project’s “community impact.” The competitive nature of attraction of tax credits to a particular project oftentimes can be measured by community impact. Every CDE measures community impact somewhat differently, but there are common themes across CDEs. Job creation and creation of high quality jobs ranks highly in highly for community impact with many CDEs. Quality jobs include jobs providing positions for residents of low-income communities and low-income individuals, jobs with sustainable and living wages, benefit packages, opportunities for advancement, and job training. Catalytic projects that will lead to further development of a low-income community tend to make projects attractive. Provision of services to a low-income population that are not otherwise provided and support from the local community, local elected officials, and the business community are other factors showing community impact. Minority ownership or impact, environmental factors, and either skill training or small business incubator promotion can be attractive projects features to various CDEs.

For profit businesses and projects, as well as not for profit organizations, are eligible for NMTC financing. Highly sought after businesses and organizations include projects anticipated to provide significant community impact. Community impact includes subjective standards and support along with objective measures such as job creation and expansion of previously limited services or offerings. Oftentimes, attractive projects include “but for” stories whereby but for the NMTC financing the business or not for profit entity may not have completed the same scale of project in the low-income community.

Focus factors in the program include provision of healthy foods in food deserts, support of community healthcare, including federally qualified health centers, advancement of job and skill training, furtherance of positive environmental impacts, and most projects located in non-metropolitan (rural) counties.

The CDFI Fund identified underserved states and territories and underserved targeted areas. Many CDEs are required to close all or a portion of their allocation in these states, territories, and areas, and CDEs receive enhanced consideration on future NMTC allocation applications for activity within these states, territories, and areas.

Targeted States and Territories:

- Arkansas

- Florida

- Georgia

- Idaho

- Kansas

- Nevada

- Tennessee

- Texas

- West Virginia

- Wyoming

- Puerto Rico

- American Samoa

- Guam

- Northern Mariana Islands

- S. Virgin Islands

Targeted Underserved Areas:

- Federal Indian Reservations

- Off-Reservation Trust Lands

- Hawaiian Home Lands

- Alaska Native Village Statistical Areas

State Program

Several states enacted complementary NMTC programs in order to attract economic activity and federal tax credit allocations. These programs work either independently or in conjunction with the federal NMTC program. State programs may provide for either additional or fewer criteria than the federal program, and transaction sizes tend to be lower for a state NMTC transaction. A typical net benefit from a state NMTC transaction would equal nine percent to 12 percent of total project costs. This benefit can be twinned or stacked with a federal NMTC transaction to enhance total project benefits.

Twinning with Other Incentives

NMTC financing flexibly works in concert with many other economic incentive programs. NMTC financing works in conjunction with Historic Rehabilitation Tax Credits, Renewable Energy Investment and Production Tax Credits, grant programs, local and state tax credit enhancements, subsidized loan programs, and bond financing. NMTC financing notably does not work alongside Low-Income Housing Tax Credits. Structuring a NMTC transaction with other incentive programs leads to increased incentives and enhancement of a project’s capital stack. Notably, NMTC financing may be paired with the new opportunity zone program in order to create a deep incentive financing with a high subsidy for a commercial project.

New Markets Tax Credits – Prospective Deal Structure

Historic Rehabilitation Tax Credit

The Rehabilitation Tax Credit (HTC) of Section 47 of the Code provides a 20 percent tax credit for certain certified historic structures approved by the National Park Service and a 10 percent tax credit for qualified rehabilitated buildings not eligible as a certified historic structure (buildings constructed and originally placed in service prior to 1936). The House legislation would have eliminated the HTC, subject to transition rules. The TCJA preserves the 20 percent HTC and eliminates the 10 percent tax credit, subject to transition rules. Currently, the 20 percent HTC may be claimed as “placed in service” for the certified historic structure, but the reconciled tax legislation provides the HTC will be ratably claimable over the five year compliance period following the certified historic structure’s status as “placed in service.” Both the elimination of the 10 percent credit and the implementation of the longer claim schedule for HTCs are subject to transition rules whereby a property owned by the taxpayer at all times after Jan. 1, 2018, and with rehabilitation construction commencing before or within 180 days of the reconciled legislation’s enactment will be eligible to have the HTC claimed by the taxpayer under prior law for a period of 24 months (or 60 months in the case of a phased rehabilitation project). While the property must be acquired and owned by the taxpayer, the Treasury Department or Internal Revenue Service must provide guidance on the transition rules as they relate to whether all of the owners or investors in a taxpayer must be in place prior to Dec. 31, 2017.

The HTC is subject to tax equity pricing adjustments because of corporate rate reductions, but the ratable spread of the credit over five years may lessen the one year impact. The spread of the claim of the HTC over five years should result in lower tax equity pricing in the amount of ten to fifteen percent due to the diminished present value of the credits. Under the TCJA, the pool of corporate taxpayers investing in HTC transactions may be limited due to the tax credits not offsetting the BEAT, a minimum tax on foreign-owned corporations or corporations with substantial foreign operations.

Infrastructure Tax Credits

The Trump Administration and Congress are formulating plans for an expansive infrastructure tax credit program in conjunction with repatriation of company profits invested overseas by United States corporations. The tax credit program, projected at $150 billion or more, would serve to leverage more than $800 million in private investment into infrastructure projects. Infrastructure may be broadly defined to include businesses supporting the “public good” including manufacturing, company headquarters, research and development, and energy production along with more traditional infrastructure, including roads, bridges, rail, airports, seaports, and transmission lines. This definition may include infrastructure essential for large scale real estate development. The proposed infrastructure tax credit program may work in a mutually beneficial manner with existing NMTC program objectives and the new qualified opportunity zone subsidies to enhance the same type of economic development projects in a broad and significant manner.

Affordable Housing and Low-Income Housing Tax Credits

The Low-Income Housing Tax Credits program has promoted the national private sector development of affordable housing since 1986. While the TCJA preserved the Low-Income Housing Tax Credits (LIHTC) under Section 42 of the Code, the House legislation proposed an elimination of tax exemption on interest from issuances of Private Activity Bonds, an integral financing tool in affordable housing projects. Low-Income Housing Tax Credits consist of two separate tax credit provisions, commonly referred to as “nine percent” and “four percent” credits. The “nine percent” tax credit is allocated on a competitive basis through state housing agencies while the “four percent” tax credit is allowable on qualified housing projects utilizing tax exempt bond issuances, or Private Activity Bonds. Therefore, the House legislation would have effectively ended the “four percent” LIHTC program, preventing the financing mechanism used by hundreds of affordable housing projects across the country on an annual basis. The reconciled TCJA preserved the LIHTC program along with Private Activity Bonds.

The LIHTC program will be subject to adjustments in tax equity pricing based upon reductions in corporate income tax rates. The proposed Affordable Housing Credits Improvement Act of 2017 sponsored on a bi-partisan basis by Senators Maria Cantwell and Orrin Hatch, not included in the reconciled tax legislation, may be taken up again in 2018 and include provisions that increase tax credit allocation to state agencies by up to 50 percent for use with “nine percent” credits and adjusters to tax basis to address the reduction in yield in LIHTC transactions resulting from lower corporate tax rates. LIHTC may be particularly exposed to pricing impact from BEAT and corporate rate reductions.

Renewable Energy Investment and Production Tax Credits

The 30 percent investment tax credit (ITC) subject to Section 48 of the Code is available for commercial solar installations and certain other technologies placed in service prior to Jan. 1, 2017. The solar ITC is subject to an annual phase down of the credit for projects commencing construction after Jan. 1, 2020, with all projects required to be “placed in service” by Jan. 1, 2024. The solar ITC has been attractive to large land owners in Florida where raw land is converted into large scale commercial solar arrays utilizing the equity from the tax credit. Residential roof top solar has also experienced a renaissance in recent years and opportunities exist to retain rooftop rights for solar and utilize tax equity generated from the solar ITC.

The House legislation proposal would have extended certain “orphaned” ITC technologies (fiber optic solar, fuel cell, microturbine, geothermal heat pump, small wind, and combined heat and power property) to match the solar ITC phase down and construction commencement timelines. The House bill would have also provided both partially clarifying and partially conflicting guidance on commencement of construction for ITC energy projects, including the codification of a physical work test, a five percent safe harbor, and a continuity requirement for construction. The TCJA does not revise the solar ITC, nor does it include “orphaned” ITC technologies or commencement of construction codification.

The production tax credit (PTC) under Section 45 of the Code is available for each kilowatt hour produced from certain renewable technologies for a period of 10 years from the date the facility was placed in service. The PTC expired for all but wind generation technologies after Dec. 31, 2016. Under current law, the wind PTC is subject to an annual phasedown beginning in 2017. The wind PTC is subject to annual adjustment for inflation. Alternatively, taxpayers may also elect to use the 30 percent ITC in lieu of the PTC. The House legislative proposal would have eliminated inflation adjustments for the wind PTC following the effective date of the legislation and adopted commencement of construction codification similar to the solar ITC proposal. The TCJA does not eliminate the inflation adjustment, nor does it include the commencement of construction codification.

Because of the pass-through of ongoing losses and depreciation, the ITC and PTC are subject to tax equity pricing adjustments because of corporate rate reductions. Also due to foreign and multi-national investors in the ITC and PTC industry, the BEAT may have a substantial impact on current and future investors. Tax extenders legislation proposed by Senator John Thune and Orrin Hatch may still yet be enacted prior to 2018 in order to extend eligibility for orphaned ITC technologies, subject to the solar ITC and wind PTC phasedown schedules.

Expanded First Year Depreciation Deductibility and Expensing for Acquisition of Capital Assets

TCJA expands first year accelerated depreciation for investment in qualified tangible property, including many categories of equipment and non-real estate capital assets, under Section 168(k) of the Code from 50 percent to 100 percent of all new investments in assets acquired and placed in service after Sept. 27, 2017, subject to a phase-down schedule following Dec. 31, 2022. Similarly, the legislation increases the amount a taxpayer may immediately expense under Section 179 of the Code from $500,000 to $1,000,000 in the year such property is placed in service with a phase-out provision increasing from $2,000,000 to $2,500,000. The expensing provision applies to qualified tangible property and is elected by the taxpayer in lieu of accelerated depreciation. These two provisions in concert are intended to increase capital investment back into businesses and grow the production of income from such investment. In the context of real estate, this bonus depreciation expansion and expensing provision will be impactful for investment in tangible personal property and FF&E and cost segregation analysis will likely be required.

Key Takeaways and Potential Qualified Opportunity Zone Benefits

Investors

- Six percent or higher after tax internal rate of return with lower risk profile for up to 80 percent of current investment portfolio appreciation

- Ability to either maintain or liquidate current investments with tax deferral and/or abatement of capital gains recognition

- Utilization of up to 80 percent of current capital gains appreciation in investments (the non-tax portion of appreciation) for utilization in the same investment or substitute investments or liquidity

- If affiliated with the project, ability to defer and/or abate capital gains while investing in new projects and growth

Projects

- Low-cost third party financing at tax advantaged rates

- Third party investor financing as low as three percent or less annualized cost to the project over a 10-year investment horizon, net of all expenses and investor tax reserves (including a share of long-term appreciation with the investor and a permanent investor contribution to the project)

- Ability to fully complete project financing with little to no debt or sponsor equity

- Ability to complete and realize projects with lower than market rate cash flow or return

- Ability to utilize financing for new construction or improvement of existing buildings (not currently owned by the project owner)

- Ability to utilize financing for new equipment or substantial improvement of equipment

- Increased subsidy for the project if utilizing affiliated investors (with capital gains appreciation on current investments)

- Ability to twin and stack with other incentive programs, notably NMTC

Fund Managers

- Substantial fees for raising capital and asset management in connection with Opportunity Funds (up to two to four percent annually)

- Ability to structure related partner level financing and/or project level standing letters of credit

Greenberg Traurig’s Tax team works with investors, projects, fund managers, and third-party financing providers to advocate for census tract inclusion and structure Opportunity Funds (O-Funds), with a focus on maximizing after tax benefits for investors and/or qualified projects (and both investors and projects in the case of project affiliated investment). For more information on utilizing one or more of these new opportunities or if you have general questions about the new program and tax legislation, please contact your Greenberg Traurig attorney.