On Budget Day, 15 September 2020, a number of tax measures were published in the Dutch 2021 Tax Plan that could have an impact on real estate investments in the Netherlands. The proposed bills include some important changes in respect of real estate transfer tax (RETT), corporate income tax (CIT), Box III, and the landlord levy. The various proposals will have effect as of 1 January 2021, with some beginning 1 January 2022, if approved by the Dutch Parliament. For more information on the 2021 Tax Plan, please refer to an earlier GT Alert.

REAL ESTATE TRANSFER TAX

Increase of tax rate

The default RETT percentage will change from 2% to 8% for both residential and commercial real estate as per 1 January 2021. For owner-occupied housing, the rate will remain 2%. For first-time home buyers between 18-35, the RETT percentage will be reduced to 0%. The proposed rate changes can be summarized as follows.

|

|

2020 |

2021 |

|

Residential first-time home buyers (18-35 years) |

2% |

0% |

|

Residential (the buyer will use it as their residence) |

2% |

2% |

|

Investors in residential real estate |

2% |

8% |

|

Commercial real estate |

6% |

8% |

As from 1 January 2021, the lower 2% rate for residential real estate will only apply to individuals who use the property as their main residence. Investors acquiring residential real estate will therefore fall in the higher 8% RETT bracket, a quadrupling of the current tax rate. This higher rate not only applies in the event of the acquisition of the real estate itself, but also if shares in a qualifying real estate company or partnership are acquired.

Exemption for first-time home buyers

The government wants to strengthen the position of first-time buyers compared to other buyers. Individuals between 18 and 35 years may therefore apply the 0% rate if they buy a house to live there themselves. This exemption may only be used once. The 0% rate will in principle apply until 1 January 2026. The acquisition of beneficial ownership of real estate is excluded from the exemption.

Tax base reduction RETT replaced by tax reduction

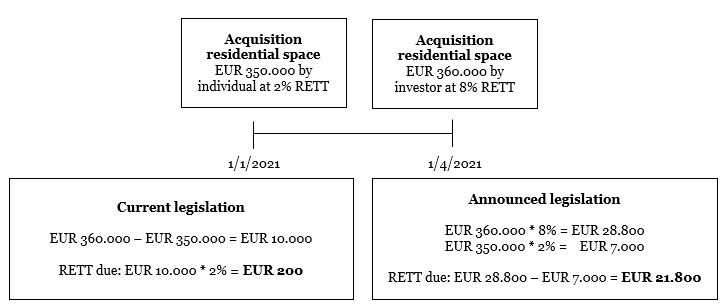

Currently, if real estate is acquired within six months of the previous acquisition, the tax base is reduced by the amount on which RETT was calculated for the previous acquisition.

Because of the proposed rate changes, the tax base reduction will be replaced by a tax reduction. The RETT that was due in respect of the previous acquisition can be deducted from the RETT due on the subsequent acquisition. This is to prevent investors acquiring residential real estate from effectively paying the lower RETT rate by using the base reduction facility. Example:

CORPORATE INCOME TAX

CIT rates

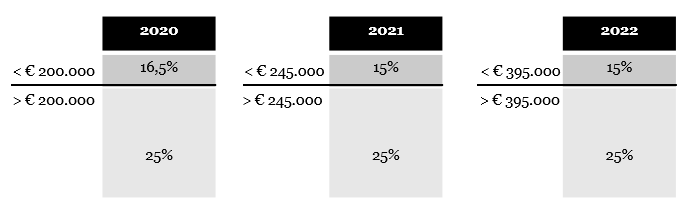

The main corporate income tax rate will remain at 25% and will not be reduced as adopted last year. The lower CIT rate of 16.5% will be decreased to 15%. The first bracket will be extended to a taxable amount of EUR 245,000 for 2021 and EUR 395,000 for 2022. The proposed CIT rates can be summarized as follows:

To accelerate loss compensation and enhance the cash-flow position, it is possible to include a ‘COVID-19 reserve’ in the 2019 CIT return. This fiscal reserve is the amount of the expected 2020 taxable loss, to the extent that such loss is related to COVID-19. However, the reserve may not exceed the 2019 taxable profit excluding such reserve. Taxpayers may request a revised provisional 2019 CIT assessment to obtain a CIT refund. Taxpayers that foresee a taxable profit for 2020 are not allowed to benefit from this measure.

Limitation of loss compensation and unlimited carry forward

It is proposed that as of 1 January 2022, annual loss compensation will be limited to 50% of the taxable profit to the extent that such profit exceeds EUR 1 million. This will apply to both carry-back and carry-forward situations. In addition, the six-year time limit on loss carry-forward will be abolished. Tax losses will therefore – subject to the above limitation – be available to offset future taxable profits for an indefinite period. This measure follows from one of the recommendations of the Dutch Advisory Committee on Taxation of Multinationals. The feasibility of this measure is still being investigated. No draft bill has been published yet.

PERSONAL INCOME TAX

Adjustment Box III

The tax on deemed income from savings and investments in Box III has been subject to debate, which is the reason for the legislative change as proposed. The tax-free allowance (currently EUR 30,846) is increased to EUR 50,000 (EUR 100,000 for fiscal partners). In addition, the applicable rate increases from 30% to 31% and the deemed income rates will be changed as follows:

|

Net Assets |

Deemed income |

|

EUR 50.000 – EUR 100.000 |

1,9% |

|

EUR 100.000 – EUR 1.000.000 |

4,5% |

|

EUR 1.000.000 and higher |

5,69% |

LANDLORD LEVY

As of 2013, landlords of regulated or social housing are being charged landlord levies. The landlord levy rate will be decreased from 0.562% to 0.526% as per 1 January 2021. The rate reduction is intended to compensate landlords for the proposed statutory rent decrease for low-income tenants of social housing.

*This GT Alert is limited to non-U.S. matters and law.