In this Issue:

United States | The Netherlands | Poland | Italy | European Union | Greater China | Japan

United States

A. Federal Trade Commission (FTC)

1. FTC to restrict future acquisitions for firms that pursue anticompetitive mergers.

On Oct. 25, 2021 the FTC issued a Prior Approval Policy Statement (the “Policy”), providing notice that FTC orders to settle investigations would require that parties that had proposed unlawful mergers receive prior FTC approval for future transactions involving the same relevant markets where violations had been alleged. This statement follows the FTC’s July 2021 vote to rescind its abandonment of that same practice in 1995. The Policy also noted that the FTC would be less likely to seek prior approvals for parties that abandoned a transaction prior to certifying compliance with a Second Request. The Commission stated that the purpose of the Policy was to conserve the Agency’s resources and limit its investigations of anticompetitive deals.

2. FTC imposes strict limits on Davita, Inc.’s future mergers following proposed acquisition of Utah Dialysis Clinics.

On Oct. 25, 2021, FTC implemented the Policy in a proposed order with DaVita, Inc. The proposed transaction involved Davita’s purchase of certain assets of Total Renal Care, Inc.’s dialysis clinics business (owned by the University of Utah). The complaint alleged that the acquisition would reduce dialysis clinic competition in Provo, Utah, an area with three such providers. The Proposed Order requires Davita to divest three clinics in the area, and restricts it from entering into any non-competition agreements with employees of the seller restricting them from working for a competitor. Additionally, the FTC included the Policy in the proposed order requiring Davita to obtain prior approval, for 10 years, for the acquisition of any interest in a dialysis clinic in Utah.

3. FTC and DOJ to hold virtual public workshop exploring competition in labor markets.

The FTC announced that, along with the DOJ, it will hold a virtual public workshop on Dec. 6–7, 2021, exploring ways to promote competition in labor markets and ways to promote worker mobility, and exploring the intersection of antitrust and labor and ways to protect workers.

4. FTC requests public comment on petition from Sartorius Stedim Biotech S.A. for agency approval of its acquisition of chromatography equipment business of Novasep Process SAS.

On Nov. 2, 2021, the FTC announced it was accepting public comments on Sartorius Stedim Biotech S.A.’s acquisition of the chromatography equipment business of Novasep Process SAS. In May 2020, Danaher Corporation agreed to divest assets to settle charges that its proposed acquisition of General Electric’s biopharmaceutical business, GE Biopharma, violated federal antitrust law, with Sartorius as the approved divestiture buyer. At the time, Sartorius agreed to obtain prior approval if in the future, it proposed to acquire Novasep’s chromatography business.

B. Department of Justice (DOJ)

1. Justice Department requires divestiture for General Shale to proceed with acquisition of Meridian Brick.

On Oct. 1, 2021, the DOJ announced that General Shale Brick Inc. will be required to divest assets in order to consummate its proposed acquisition of Meridian Brick LLC, due to DOJ concerns. Both companies are two of the largest suppliers of residential brick in the country. The DOJ alleged that the divestiture was required in order to preserve competition, and avoid price increases and lower quality product, in the market for residential brick in certain markets in the southern and midwestern United States (Tennessee, Alabama, Kentucky, Indiana, Michigan and Ohio). The proposed divestiture includes the sale of three manufacturing facilities, 14 distribution yards and showrooms, and six mines to RemSom LLC or an alternative approved party.

2. Justice Department requires divestitures in Neenah Enterprises Inc.’s acquisition of US Foundry.

On Oct. 14, 2021, the DOJ announced that Neenah Enterprises Inc. would be required to divest more than 500 gray iron municipal casting pattern assets (which are customized molded iron products including manhole covers to access underground areas) in order to proceed with its proposed acquisition of almost the entirety of the assets of U.S. Foundry and Manufacturing Corporation. The companies are two of three main suppliers of gray iron municipal castings in 11 states. The DOJ alleged that the merger as originally structured would lead to higher prices, lower quality, and slower delivery times for the products.

3. Former security services executives plead guilty to rigging bids for Department of Defense security contracts.

On Oct. 14, 2021, the DOJ announced that two former employees of G4S Secure Solutions had pleaded guilty to criminal antitrust charges relating to a conspiracy to rig bids, fix prices, and allocate customers for defense-related security services contracts. Both defendants are Belgian nationals residing in Belgium. According to the DOJ, these employees conspired with their competitor businesses to allocate security contracts and set prices on contracts with the United States Department of Defense and the North Atlantic Treaty Organization (NATO) Communications and Information Agency. The company itself already pleaded guilty, several other members of the conspiracy have been indicted, with the department’s investigation ongoing.

4. Justice Department sues to block Penguin Random House’s acquisition of rival publisher Simon & Schuster.

On Oct. 18, 2021, the DOJ announced the filing of its complaint to block Penguin Random House’s proposed acquisition of Simon & Schuster. Both parties compete in the book publishing industry to acquire manuscripts to sell as books (with Penguin Random House being the largest book publisher in the world and Simon & Schuster the fourth largest in the United States). The complaint alleges that the acquisition essentially would enable Penguin Random House to control what books are published in the United States and set the price on how much authors are paid. The DOJ had particular concerns that the publishing industry was already highly concentrated with five main players, putting smaller publishers at a disadvantage. The complaint also alleges that the merger would harm American authors, under a monopsony theory (or consolidation among buyers). Acting Assistant Attorney General Richard A. Powers of the Justice Department’s Antitrust Division stated of the action: “In stopping Penguin Random House from extending its control of the U.S. publishing market, this lawsuit will prevent further consolidation in an industry that has a history of collusion.”

C. U.S. Litigation

1. In re: Germ. Auto. Mfrs. Antitrust Lit., No. 20-17139, 2021 WL 4958987 (9th Cir. Oct. 26, 2021).

The Ninth Circuit issued a memorandum opinion affirming the decision by U.S. District Court Judge Charles Breyer, who dismissed a proposed “direct purchaser” class action brought on behalf of U.S. car dealers. The case arose over an alleged scheme to avoid an “arms race” by the leading German car manufacturers over clean diesel and electric vehicles. According to the allegations, defendants coordinated product updates and refreshes and allocated markets in order to minimize competition. The direct purchasers also alleged that the defendants had engaged in a conspiracy to limit development of electric vehicles. The direct purchasers’ references to purported “plus factors” did not save their § 1 claim from dismissal. According to the court, “common motive does not suggest an agreement.” The court went on to state that defendants’ conduct did not constitute an “extreme action against self-interest” because a non-conspirator did not release its first all-electric vehicle until 2018. According to the Ninth Circuit, the coordinated product updates and refreshes and limited development of electric vehicles “could just as easily suggest rational, legal business behavior by the defendants as they could suggest an illegal conspiracy.”

2. Wolfire Games, LLC. v. Valve Corp., Case no. 2:21-cv-00563, 2021 WL 4552447 (W.D. Wash. Oct. 5, 2021).

Plaintiff filed suit alleging that Valve “explicitly instructs or tacitly requires” developers to comply with most favored nations (MFN) provisions which prevent developers selling games on Valve’s Steam Store and Steam Gaming Platform from offering better prices elsewhere. Plaintiffs, who are gamers, say these MFN provision have kept prices artificially high because competition with other platforms would drive down rates charged for PC games. According to the court, Valve Corp. can compel arbitration of consumer antitrust claims over its “Steam” distribution platform for computer and video games, but in the meantime the company must still litigate a parallel proposed class action on behalf of software developers. The court ruled that consumers agreed to the arbitration clause when they began playing on Valve’s platform. According to the court, the parents, who are bringing these claims on behalf of their children, “effectively appointed their children as their agents when they purchased games on their parents’ behalf using the parents’ credit card.” Absent this appointment, the parents would not have standing. As a result, the arbitration clause binds the parents’ claims. The class action claims by game developers could proceed.

The Netherlands

A. Dutch ACM decisions, policies, and market studies.

1. ACM: EU gatekeeper law should have a bigger role for national watchdogs.

According to the ACM, national competition authorities should play a bigger role under the Digital Markets Act (DMA). The DMA, proposed by the EU, is considered a “digital gatekeepers law.” The DMA sets out 18 prohibitions and responsibilities for businesses considered “gatekeeper platforms.” Although the EU Commission considers itself at the heart of enforcement of the DMA as the EU’s antitrust regulator, it would be good—according to the ACM—if there were a better referral mechanism in the proposed law. Considering the number of people the Commission will appoint to deal with the cases, ACM believes that national support leads to greater efficiency and less fragmentation.

2. Dutch regulators to cooperate to strengthen the supervision of digital activities.

To strengthen the supervision of digital activities, the ACM, the Dutch Data Protection Authority (AP), the Dutch Authority for the Financial Markets (AFM), and the Dutch Media Authority (CvdM) will cooperate more intensively. To that end, they have launched the Digital Regulation Cooperation Platform (SDT).

According to the ACM, a coherent and coordinated approach is required to respond actively to developments in the digital arena. Within the SDT, the supervisory authorities will cooperate by sharing their knowledge and experiences from supervisory practice (such as artificial intelligence, algorithms, data processing, online design, personalization, manipulation, and misleading practices). In addition, the supervisors jointly will address digital market issues by exploring where they are able to strengthen each other’s work in enforcement.

3. ACM announces that energy suppliers may not simply cease supply because of higher energy prices.

According a statement issued by the ACM, businesses can only supply energy to consumers if they have an ACM-issued license. The ACM monitors whether suppliers can guarantee a secure supply of natural gas and electricity to consumers. The ACM has received various reports from consumers that their energy supplier has unilaterally cancelled their energy contract or offered a contract with a variable rate instead.

Terminating the supply of energy without prior warning and without giving notice is not allowed under any circumstance, regardless of what is included in the contract’s general terms and conditions. ACM cannot intervene in any energy company’s financial decisions, but it can revoke their licenses if the security of supply is at stake. Therefore, the ACM has reminded energy companies that they cannot unilaterally terminate contracts and that they cannot stop their supply of energy to consumers because the prices of energy have risen.

4. ACM imposes cartel fines for price-fixing agreements involving the purchase of used cooking oil.

Two major collectors of used cooking oil (UCO) were fined a total of almost 4 million euros by the ACM for making cartel agreements regarding the purchase of used cooking oil.

UCO is an important and sustainable raw material for biodiesel. Collectors buy UCO mainly from catering businesses and the food industry. The collectors in question were in regular contact about the purchase prices they paid to suppliers of UCO. The companies colluded in order to keep purchase prices as low as possible, thereby enabling them to improve their margins. They also shared suppliers among each other and exchanged competitively sensitive information. Small hospitality businesses in particular were harmed by the cartel agreements.

5. ACM allows Dutch health insurers to settle extra COVID-19 costs in 2021.

The ACM has decided that health insurers are still allowed to mutually divide exceptional extra costs for COVID-19 treatment this year. Agreements on mutual financial settlement of costs between health insurers are ‘normally’ against competition rules. In assessing this agreement, the ACM therefore considered, on the one hand, the uncertainties surrounding the impact of COVID-19 and, on the other, the importance of the continuity of health care. In view of the laws the ACM supervises—which offer room for cooperation to prevent people and businesses from bearing the brunt of the COVID-19 crisis—the ACM will not intervene if the cooperation is in the general interest of people and businesses.

In assessing the agreement, the ACM took into consideration the fact that health insurers typically must assess risk in the relevant market in determining their financial projections and budgets for a given year. ACM lacked any insight into the risks and costs associated with COVID-19’s impact on this market. However, ACM did determine that this is the last year that it will allow health insurers to make joint agreements to share the most disruptive costs of COVID-19. In addition, the ACM warned that the insurers must limit the joint arrangement to what is strictly necessary.

B. Dutch Courts

1. CBb upholds disputed decision on connection obligation for wind farm.

Readhuys sought a connection to Liander’s electricity grid for its four wind turbines. Earlier in 2021 the ACM ruled that Readhuys was entitled to a connection. Liander disagreed and appealed to the Dutch Trade and Industry Appeals Tribunal (CBb). The CBb upheld the ACM’s dispute decision, noting Liander’s statutory connection obligation. There is an exception to this obligation, when the wind turbines of the wind farm must be operated by the same company. The CBb agreed with the ACM that in this case there is no exception to the statutory connection requirement. With the ruling of the CBb, the decision of the ACM is final.

2. Ruling of CBb in appeal against Neutrality Levy Code Decree.

The CBb dismissed (link in Dutch) the appeal brought by Vereniging Energie Nederland (VEN), upholding the ACM’s Code Amendment Decision on the neutrality levy and exceeding the credit limit.

VEN argued that a provision should have been included in the contested decision stating that the ACM should check whether all measures have been taken prior to imposing the neutrality levy because it is unclear which criteria the ACM uses. According to the CBb, however, the general rules regarding administrative decision-making provide sufficient starting points for safeguarding the principals involved when assessing the levy by the ACM in a concrete case.

Poland

A. Implementation of the EU Directive on Unfair Trading Practices in Poland.

Poland is now implementing EU Directive 2019/633—adopted April 17, 2019—on unfair trading practices in business-to-business relationships in the agricultural and food supply chain. This directive contains new rules banning certain unfair trading practices imposed unilaterally by one trading partner on another. The directive introduces a minimum common standard of protection across the EU, following the acknowledgment of significant concerns about unfair trading practices at the national level.

Generally, according to the Polish regulations, the use of contractual advantage is unfair if it is contrary to morality and threatens the essential interest of the other party or violates such interest. The new rules will apply in cases of considerable disproportionate economic potential between the supplier and the buyer of agricultural or food products. However, unlike the directive, the Polish regulations provide for the prohibition of unfair use of contractual advantage not only by the buyer against the supplier, but also by the supplier against the buyer.

In line with the directive, the new rules introduce important changes to the current regulations. First, the new rules provide for a non-exhaustive list of prohibited practices Also, the new rules extend the definition of agricultural or food products to include live animals, oil seeds and oleaginous fruit, etc., and extends the definition of a purchaser to include public authorities. It also introduces the same turnover thresholds as provided for in the directive, to be achieved by a buyer and a supplier to determine the extent of the economic disproportion between them. The Office of Competition and Consumer Protection (OCCP) can initiate proceedings, require buyers and suppliers to provide necessary information, carry out unannounced inspections, order the discontinuation of illicit practices, accept commitments, and most importantly, impose fines of up to 3% of the turnover of the fined undertaking. To a limited extent, fines can be also imposed on a managing individual.

Italy

A. The Italian Competition Authority (ICA) conditionally clears the merger between SIA and Nexi.

On Oct. 12, 2021, the ICA authorized, subject to conditions, the merger by incorporation of SIA S.p.A. into Nexi S.p.A. By this decision the ICA closed an investigation opened Aug. 31, 2021, due to possible competition concerns arising in some of the markets affected by the transaction. The merger involves two leading players in the field of digital payments and concerns a number of sectors: merchant acquiring, processing, payment card issuing, retail payment clearing, interbank data transmission, as well as services for the supply and maintenance of ATMs.

The ICA stressed that, due to regulatory harmonization at the EU level that also fostered vertical integration between operators, the effects of the transaction should be assessed on the basis of a supra-national market definition, encompassing foreign players capable of exerting competitive pressure on the merged entity. Nevertheless, the ICA found that certain markets at issue were only national in scope; thus, the merger is likely to result in the creation or strengthening of the dominant position of the post-merger entity in the national markets for ATM card processing and clearing services for non-SEPA products, although the expected evolution of these markets indicates this situation is temporary.

Therefore, to clear the transaction, the ICA imposed both behavioral and structural remedies. Specifically, the parties agreed to implement the following measures: (i) Nexi waived the exclusivity contained in the contracts with equensWorldline in relation to domestic processing and non-SEPA clearing services; (ii) Nexi and SIA committed to a non-discriminatory, clear and transparent offer with regard to the domestic card acquiring processing and issuing processing activities, until the new Bancomat platform becomes operational, and, for a period of three years, in relation to the clearing of non-SEPA products; and (iii) the transferring of non-SEPA clearing contracts currently in force between Nexi and its client banks.

B. ICA closes with commitments an investigation on the Italian Association of Insurance Companies.

On Oct. 4, 2021 the Italian Competition Authority (ICA) closed the investigation proceedings initiated on Nov. 3, 2021, against the National Association of Insurance Companies (ANIA).

The proceeding was initiated following a communication sent to ICA by ANIA itself concerning an anti-fraud project for the life and non-life sectors providing, among other things, for the creation of databases and the development of common algorithms to determine indicators of the risk of fraud. According to ICA, the project implied a risk that the development of common algorithms could influence and standardize the choices of the companies in essential phases of the insurance business. Moreover, ICA feared that the sharing of a large amount of data could facilitate collusion. ICA was also concerned by insufficient guarantees about the fact that anti-fraud activities could be effectively carried out for the benefit of all stakeholders.

ANIA undertook several commitments to resolve the critical competition issues indicated in the initiating measure, which mainly consisted of substantial changes to the anti-fraud project as initially communicated. Such commitments include: (i) to circumscribe the possible uses of the databases; (ii) to foresee safeguards to guarantee their correct use; and (iii) to allow the widest adherence to the project. ICA has therefore considered that the commitments submitted by ANIA are suitable to address its competition concerns. ICA’s considerations also considered that anti-fraud activities can lead to significant cost savings, which may translate into lower prices and benefits for the community as a whole.

European Union

A. European Commission

1. The General Court dismisses LOT’s challenges against the Commission decisions authorizing the acquisition of certain assets of Air Berlin.

Due to a deterioration of its financial situation and loss of financial support by shareholders, in August 2017 Air Berlin filed for insolvency. Air Berlin benefitted from a State-guaranteed loan to enable operation continuity and subsequent disposal of its assets.

In October 2017, Air Berlin concluded two asset transfer agreements (i) one with Lufthansa concerning a number of assets (slots as well as aircraft and their crew); (ii) one with EasyJet regarding mainly slots at Berlin-Tegel airport.

Both mergers were notified and cleared by the Commission. Interestingly, the Commission—for the first time in a passenger airline merger—did not define the relevant markets by city pairs between a point of origin and a point of destination (“O & D markets”). Conversely, the Commission aggregated, for the purposes of its analysis, all the O & D markets to and from each of the airports with which those slots were associated. In doing so, it defined the relevant markets as those for air passenger transport services to and from those airports.

A Polish competitor airline, LOT, challenged both clearances, alleging that the Commission applied an erroneous methodology in its review of the mergers. By judgments of Oct. 20, 2021, the General Court (GC) rejected LOT’s pleas on the following grounds, among others:

- the GC confirmed that the Commission applied a correct market definition, stressing that Air Berlin had ceased operating prior to the mergers so that the transferred slots were not associated with any relevant market;

- the GC pointed out that, when exercising its powers under the EUMR, the Commission enjoys a margin of discretion on complex economical assessments, which must be taken into account by the Courts in their review;

- the plea whereby the Commission should have taken into account previous rescue aid granted to Air Berlin in its assessment was rejected, as such financial support did not form part of the assets transferred to Lufthansa.

2. CJEU in Sumal ruling: downward attribution of liability is, under certain circumstances, allowed.

On Oct. 6, 2021, the CJEU ruled in the Sumal case that a party that suffered damage from infringement committed by a parent company may, under certain conditions, also seek compensation for the resulting damage from that company’s subsidiary. Sumal is based on the EC decision of July 19, 2016, in the well-known Trucks case.

For a downward attribution of liability, both entities must form part of the same economic unit at the time of the infringement. In contrast to establishing an economic unit for the purpose of parental liability (upward attribution of liability) which can be solely based on the economic, organizational, and legal links between the infringing subsidiary and its parent company, for the purpose of a downward attribution of liability there must also be a link between the subsidiary’s economic activity and the infringement’s subject matter.

In CJEU case law, the concept of an “undertaking” within the meaning of Article 101 TFEU covers any entity engaged in an economic activity, irrespective of its legal status and the way in which it is financed. The notion of “undertaking,” however, is functional, and the economic unit involved must be identified taking into consideration the subject matter of the infringement at issue.

B. European Commission Policy Brief on Sustainability and Antitrust.

In a Policy Brief, the European Commission has set out its preliminary views on how the sustainability objectives of the “European Green Deal” can be incorporated into EU competition rules. Once the ongoing revision of the Horizontal Cooperation Guidelines is completed, more clarity will emerge on antitrust and sustainability. The guidelines will contain examples of “antitrust proof” cooperation agreements with sustainability objectives. In addition, the guidelines will contain how anti-competitive sustainability partnerships can avoid the application of EU competition rules under Article 101(3) TFEU.

The Policy Brief indicates more leeway for companies that make anti-competitive sustainability agreements. It is recognized that the positive effects of a restrictive agreement may outweigh its negative effects on the market. However, while the ACM aims to promote sustainability agreements whose anti-competitive effects are offset by their environmental benefits, the Commission will only give a green light if consumers are fully compensated for the negative effects.

Greater China

2020 and 2021 witnessed significant developments in China’s antitrust legislation and enforcement. On Oct. 23, 2021, the Standing Committee of the National People’s Congress released a draft amendment (“Draft”) to the Anti-Monopoly Law ( AML), soliciting public comments through Nov. 21, 2021. The Draft could be deemed a summary of the legislative and enforcement progress, as well as a response to speculations. Some highlights of the Draft are presented below:

- The upper limit of fines for violations of AML has been largely increased. According to the Draft, punitive fines of two to five times the basic fines will apply in case of serious violations. In practice, it is the overall turnover of an undertaking, rather than the turnover from the products in question, that constitutes the baseline (annual turnover of the last year) for calculating the amount of fine. Therefore, sky-high fines may result if the Draft were adopted officially. The quantitative criteria for the “seriousness” of the violation are yet to be published. Personal liability of the management of an undertaking for the first time appeared in the Draft.

|

Violations |

Current Upper Limit of Fines |

Upper Limit under the Draft Please note that punitive fines could be as high as two to five times of the basic fines below in case of serious violations |

|

/ |

/ |

Basic Fines |

|

Violation relating to concentration (e.g., failure to declare, concentration after declaration without approval, violation of conditional approval or prohibition on concentration) |

No more than RMB 500,000 |

No more than 10% of the annual turnover of the last year, if the concentration restricts or may restrict competition; No more than RMB 5 million, if the concentration does not restrict competition |

|

Conclusion and implementation of monopoly agreements |

1% to 10% of the annual turnover of the last year |

1% to 10% of the annual turnover of the last year, or no more than RMB 5 million if there is no turnover last year |

|

Conclusion without implementing monopoly agreements |

No more than RMB 500,000 |

No more than RMB 3 million |

|

Legal representatives, main responsible personnel personally liable for the conclusion of monopoly agreements |

None |

No more than RMB 1 million |

|

Abuse of market dominance |

1% to 10% of the annual turnover of the last year |

1% to 10% of the annual turnover of the last year |

- The Draft emphasizes platform economy and its antitrust compliance. The Draft proposes to introduce into a basic Chinese law prohibition on restrictive measures taken by those with market dominance against other undertakings through data, algorithm, technology, and platform rules. Besides, SAMR is required to strengthen the review on concentration in industries of livelihood, finance, technology, and media, which may overlap with platform economy.

- Safe harbor rules, similar to their EU counterparts, for vertical and horizontal monopoly agreements are introduced into the Draft. As long as the undertakings can prove their market share in the relevant market is lower than the threshold prescribed by SAMR, the prohibition on monopoly agreements will not apply, unless a restrictive effect is substantiated by evidence.

- According to the Draft, resale price fixing agreements (fixing the price of resale to third parties or fixing the lowest price of resale to third parties) are no longer prohibited, provided that the undertakings can prove that such conducts pose no restrictive effect. However, such rule-of-reason exemption does not apply to horizontal agreements.

Japan

A. Summary of the Annual Report of the JFTC for FY 2020.

The Japan Fair Trade Commission (JFTC) issued its annual report for FY 2020. According to the report, in FY 2020, 101 cases were examined for alleged violation of the Antimonopoly Act, of which 91 cases were completed within the same year.

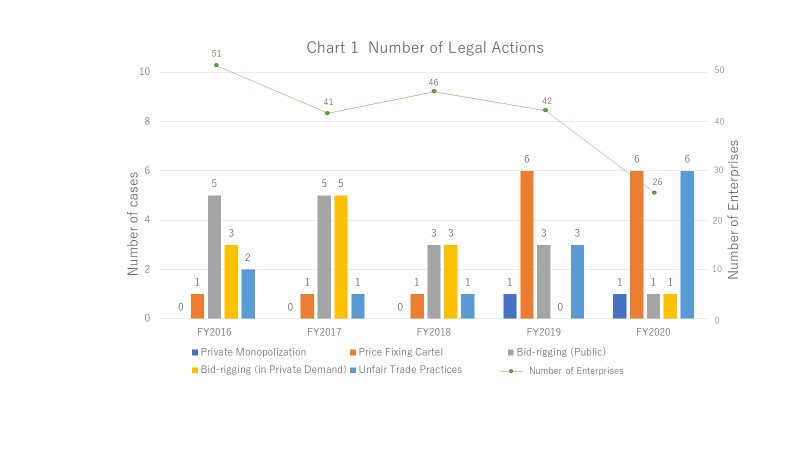

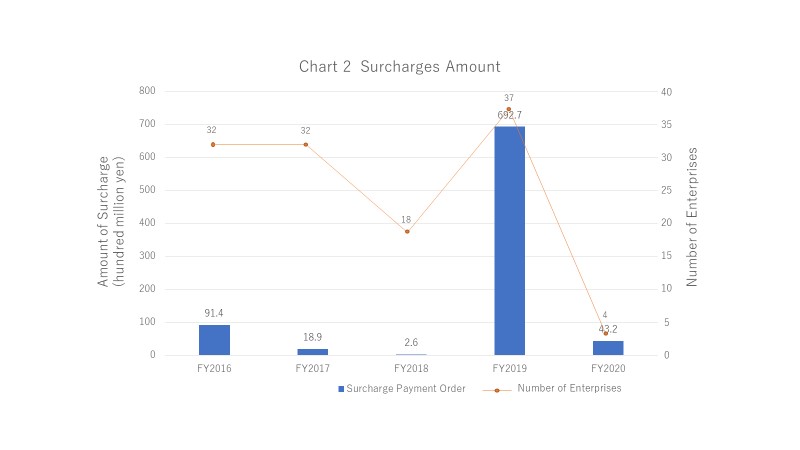

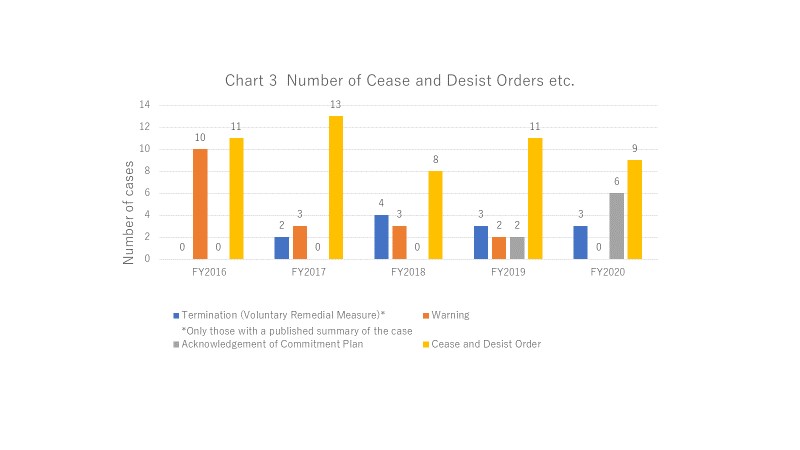

As depicted in the charts below, 15 legal actions (cease and desist orders and approval of commitment plans) were taken. Organized by type of action, there was one case of private monopolization, six cases of price-fixing cartels, one case of bid-rigging (public), one case of bid-rigging (in private demand), and six cases of unfair trade practices (see Chart 1). As for surcharges, a total of 4,329,230,000 yen in surcharge payment orders were issued to a total of four enterprises (see Chart 2). Additionally, there were six cases in which an enterprise’s conduct was suspected of violating the Antimonopoly Law, and a notice of commitment procedure was issued. They applied for approval of the commitment plan, and the plan was approved because it was deemed to comply with the approval requirements under the Antimonopoly Law.

Read previous editions of GT’s Competition Currents Newsletter.