| Go-To Guide: |

New Requirements Include:

|

On May 3, 2023, the Securities and Exchange Commission (SEC) adopted amendments to issuer share repurchase disclosure rules, aimed at providing investors with enhanced information to enable them to better “assess the efficiency, purposes, and impacts of share repurchases.”[1] The new rules require all domestic issuers, foreign private issuers (FPIs) (except those that file pursuant to the Multijurisdictional Disclosure System), and registered closed-end management investment companies (“listed closed-end funds”) to provide additional disclosures regarding share repurchases by or on behalf of the issuer or an affiliated purchase.

Tabular Disclosure of Daily Repurchase Activity

Issuers must provide tabular disclosure of daily quantitative share repurchase data (and tag such data using Inline XBRL) as follows:

- Domestic issuers must provide tabular data on new Exhibit 26 to Form 10-K and Form 10-Q (see Appendix A below for required tabular data);

- FPIs must provide similar tabular data in a new Form F-SR on a quarterly basis, which must be filed within 45 days after the end of each fiscal quarter; and

- Listed closed-end funds must provide similar tabular data in annual and semi-annual reports on Form N-CSR.

Required Checkbox. The amendments require issuers to include a checkbox above the tabular disclosure indicating whether any of their directors or officers[2] purchased or sold shares that are the subject of a share repurchase plan or program within four business days before or after the public announcement of that repurchase plan or program.

In light of the amendments, the SEC eliminated the current requirements in Regulation S-K, Form 20-F and, Form N-CSR to disclose monthly repurchase data in periodic reports.

Narrative Disclosure Regarding Repurchase Programs and Practices

Issuers must provide narrative disclosures in Form 10-K and Form 10-Q under Regulation S-K, Item 703; in Form 20-F under Item 16E, and in Form N-CSR under Item 14 regarding repurchase programs and practices addressing:

- The objectives or rationales for each share repurchase plan and the process or criteria used to determine the amount of repurchases; and

- The number of shares purchased other than through a publicly announced plan or program and the nature of the transactions (e.g., whether the purchases were made in open market transactions, tender offers, in satisfaction of the issuer’s obligations upon exercise of outstanding put options issued by the issuer, or other transactions);

- Descriptive information with respect to publicly announced repurchase plans or programs, including:[3]

- The date each plan or program was announced;

- The dollar amount (or share/unit amount) approved;

- The expiration date (if any) of each plan or program;

- Each plan or program that expired during the relevant period; and

- Each plan or program the issuer has determined to terminate prior to expiration, or under which the issuer does not intend to make further purchases.

- Any policies and procedures relating to purchases and sales of the issuer’s securities by its officers and directors during a repurchase program, including any restriction on such transactions.

Quarterly Disclosure Regarding Rule 10b5-1 Trading Arrangements

Under new Item 408(d) of Regulation S-K, issuers will be required to disclose on a quarterly basis in Form 10-K and Form 10-Q the adoption or termination of any Rule 10b5-1 trading arrangements (and tag such disclosure using Inline XBRL), including a description of the material terms of a Rule 10b5-1 trading arrangement (other than price), such as:

- The date on which the issuer adopted or terminated the Rule 10b5-1 trading arrangement;

- The duration of the Rule 10b5-1 trading arrangement; and

- The aggregate number of securities to be purchased or sold pursuant to the Rule 10b5-1 trading arrangement.

Item 408(d) does not apply to FPIs filing on FPI forms or listed closed-end funds.

Timing for Compliance

Compliance dates vary depending on the type of issuer as follows:

- Domestic issuers (and FPIs that file on domestic forms) must provide the required disclosure in their Form 10-Q or Form 10-K (for their fourth fiscal quarter) beginning with the first filing that covers the first full fiscal quarter that begins on or after Oct. 1, 2023.

- FPIs that file on the FPI forms must provide the required disclosure in new Form F-SR beginning with the first full fiscal quarter that begins on or after April 1, 2024. Narrative disclosure will be required beginning with the first Form 20-F filed after the first Form F-SR has been filed. For FPIs with a Dec. 31 year-end, this means that the Form F-SR will be required to be filed on or prior to Aug. 14, 2024, with respect to the quarter ending June 30, 2024.

- Listed closed-end funds must provide the required disclosure in periodic reports beginning with the Form N-CSR that covers the first six-month period that begins on or after Jan. 1, 2024.

Notable Changes from the Proposed Amendments

The proposed amendments, initially released in December 2021, would have required daily SEC filings of repurchase data. In a significant change, the final rules instead require that daily quantitative repurchase data must be disclosed quarterly or, in the case of listed closed-end funds, semi-annually. However, unlike the proposed amendments, the daily quantitative repurchase data required by the final rules will be treated as filed with the SEC rather than furnished, and therefore subject to liability for false or misleading statements under the securities laws. Also of note, the SEC did not adopt a “cooling-off” period for issuers, which had remained an open question following the SEC’s adoption of a mandatory “cooling-off” period with respect to Rule 10b5-1 trading plans for officers and directors in December 2022. In another change from the proposal, for FPIs, the checkbox disclosure requirement applies to any director and member of senior management who would be identified pursuant to Item 1 of Form 20-F, regardless of whether the FPI is reporting on the forms exclusively available to FPIs or on the domestic forms.

Application to FPIs

As discussed herein, FPIs will now be required to provide quarterly tabular disclosure of their daily repurchase activity in new Form F-SR. Among other matters, the dissenting Commissioners were critical of the expanded disclosure requirements for FPIs, which have historically not been required to make quarterly filings. In his dissenting statement, SEC Commissioner Mark Uyeda noted that the change “fundamentally upends the Commission's long-standing and bipartisan approach of largely deferring to the disclosures made by FPIs pursuant to their home country reporting requirement.”

Key Takeaways and Action Items

Issuers should begin preparing for the rule changes now as follows:

- Consider whether any changes are needed to disclosure controls and procedures in place to ensure all repurchase data that is required to be disclosed in quarterly filings is collected and shared with appropriate personnel to facilitate timely completion of the tabular disclosures.

- Consider discussing with banks and brokers their ability to track and provide the required information.

- Review existing insider-trading policies and consider whether to prohibit any trading by directors and officers in the four-day period prior to or after the announcement of new or amended repurchase plans.

- Consider whether to adopt any new or revised policies or practices relating to share repurchases, including with respect to Rule 10b5-1 trading arrangements. The board of directors should review, and revise if needed, the objectives or rationales for the issuer’s share repurchases, the process or criteria used to determine the amount of repurchases approved, and policies relating to any officer or director trades in the four-day period prior to or after the announcement of new or amended repurchase plans.

- Ensure that ongoing or future repurchases are consistent with the issuer’s disclosed objectives, rationales, and policies.

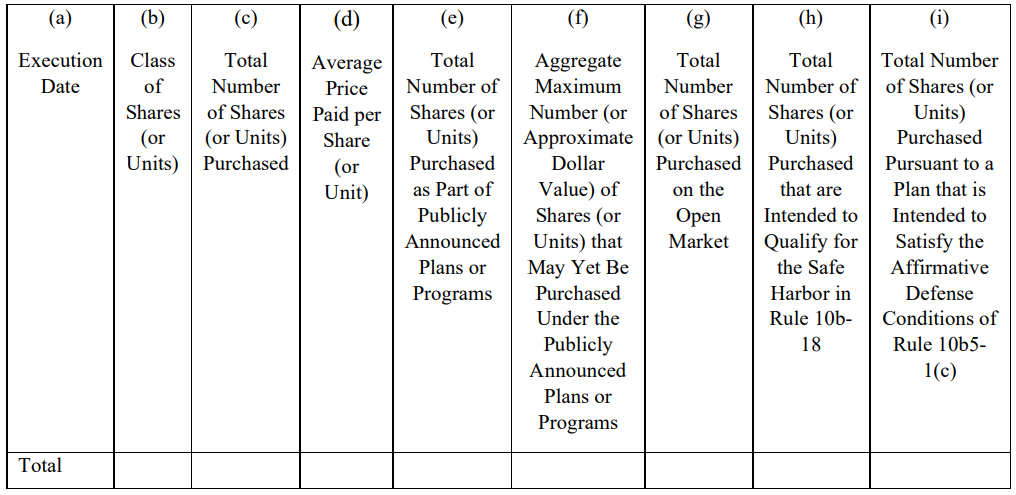

Appendix A

Every issuer that has a class of equity securities registered pursuant to Section 12 of the Exchange Act that files a Form 10-Q or Form 10-K must file, in the following tabular format, an exhibit to those reports disclosing, for the period covered by the report (or the fourth fiscal quarter, in the case of the Form 10-K), the total purchases made each day by or on behalf of the issuer or any “affiliated purchaser” of the issuer’s securities.

[1] See final rule and fact sheet.

[2] Refers to directors and officers subject to the reporting requirements under Section 16(a) of the Securities Exchange Act, as amended (the “Exchange Act”) (for domestic corporate issuers and listed closed-end funds), or directors or senior management that would be identified pursuant to Item 1 of Form 20-F (for FPIs, whether filing on the forms exclusively available to FPIs or on the domestic forms).

[3] The existing rules required footnote disclosure of this information.