In This Issue:

2022 Industry Trends | China’s Regulatory Framework for AD | Events & Speaking Engagements | Industry Articles

2022 Industry Trends to Watch

2021 was a transformative year in development, adoption, funding, and M&A activity in the robotics industry. 2022 is off to a robust start, and all signs point to rapid robotics growth over the next decade.

5 Trends to Watch in 2022: Robotics

By Todd C. Basile, David J. Dykeman, and Roman Fayerberg

- Growing Investment in Robotics Companies – Investors continue funding the latest robotics innovations in various industries, including the medical, manufacturing, logistics, hospitality, and automotive sectors. With plenty of cash in the market, venture capital (VC), private equity (PE), and strategic investors aim to capitalize on and steer development of disruptive robotics technologies.

- Intellectual Property (IP) Is Critical for Robotics Innovations – Patents and trade secrets continue to be essential tools for protecting robotics innovations and maintaining a competitive edge. Strategic companies will increasingly leverage design patents to protect the “look and feel” of robots and user interfaces in addition to the “how it works” protections afforded by utility patents.

- Cobots Take Center Stage in the Workplace – Many companies dream of full automation, but the reality is there are many tasks robots just can’t perform as well as humans at this stage. Cobots (robots that work alongside humans) will help bridge the automation gap as developers continue efforts to perfect robotic artificial intelligence (AI). Companies will also look to cobots to help smooth the transition of integrating robot platforms into their operations.

- Progress in Robot Interoperability – As companies adopt robotic platforms from multiple developers, these diverse platforms need to be able to communicate and work together. This interoperability, which is similar to standard setting and interoperability pushes in analogous tech industries (e.g., computers, telecom), is expected to become more prevalent as robotics adoption becomes more widespread.

- Increased Efforts to Prevent Hacking and Mitigate Liability – Hacking will continue to be a top concern for the robotics industry as hackers taking control of robots could cause significant damage, disruption, and even bodily harm. Questions of liability also arise in this context, which also are driving an intensive push by industry and government to head off evolving threats.

5 Trends to Watch in 2022: Drones

- Growth in Government and Commercial Use – Infrastructure and agricultural applications will continue to lead commercial growth. Unmanned aircraft are vital to sustaining the nation’s aging infrastructure, from inspecting bridges and pipelines to prioritizing the repair of critical works in the aftermath of natural disasters. Drones are increasingly utilized to combat the effects of climate change, giving farmers additional tools for monitoring water needs and crop health, and giving firefighters the ability to better coordinate wildfire response efforts.

- Effects of Federal Aviation Administration (FAA) Rule Changes – In April 2021, the FAA loosened its rules for commercial operations of small drones (those weighing less than 55 lbs). Previously, such unmanned aircraft were generally not allowed to fly over people, fly at night, or be out of the line of sight of the operator without an FAA waiver. Now, these drones can operate at concerts, sporting events, and for security purposes, albeit with certain constraints. Watch for new players and more dollars in e-commerce package delivery via drones in coming years.

- A Potential $64 Billion Industry Primed for Investment – Just as the FAA’s last major rule change in 2016 helped fuel commercial drone operations, the regulator’s 2021 changes may encourage even greater market growth. With predictions that the global drone industry will be worth around $64 billion by 2025, analysts expect more investors will participate.

- NASA’s Aircraft and Drone Traffic Management System – NASA’s Air Traffic Management eXploration project aims to smoothly integrate more and more drones into a crowded U.S. airspace. Safety, both for manned aircraft and persons on the ground, will be paramount to continued growth of the commercial drone industry, especially over urban areas.

- Reduced Insurance Premiums Driving Mainstream Adoption – Utilities and other companies are rethinking how they perform inspections, maintenance, and repairs – especially when replacing risky manned activities with drones can substantially reduce a company’s general liability insurance premiums. Imagine using a flying camera to safely inspect high-voltage power lines from the ground instead of trying to hover a helicopter close enough for a lineman – sitting on the skids – to have a proper look. This tactic will soon be deployed whenever possible, such as in the construction industry which has benefited from time and cost savings during required visual site inspections.

5 Trends to Watch in 2022: Autonomous Vehicles

- AI Training Continues to Be a Priority towards Widespread Adoption – Technology for autonomous vehicles (AV) - largely self-driving cars and trucks - has advanced quickly but must mature significantly before it can be allowed to operate without substantial constraints. The primary challenge is how the technology will handle difficult-to-predict situations, including sharing the road with erratic and distracted human drivers. These are difficult to “hard code” and thus artificial intelligence must be “trained” into the platform. To further this goal and advance machine learning, many AV companies are building up their database of trainable experiences through both simulation and on-road testing.

- Watch for AV Adoption in “Middle Mile” Transportation First… – As gas prices increase and drivers are harder to find, “middle mile” automated transportation is a growing need. The middle mile, which constitutes mostly straight-forward highway driving, is an expensive part of logistics and supply chains that is ripe for efficiency gains and cost savings. Implementing AV models for middle mile transportation requires the least amount of AI ability to replace human judgment. Vehicles are usually set at controlled speeds and make infrequent turns or lane changes, minimizing the risk of accidents.

- …But Robo-Taxis and Urban Air Mobility Will Come – Eventually – Despite the COVID-19 pandemic, cities continue to grow – along with traffic congestion and greenhouse gas emissions. Ridesharing and electric vehicles are helpful mitigators, but streets filled with human drivers will always be inefficient from a traffic management standpoint. Safety remains a very high barrier to widespread adoption of robo-taxis and urban air mobility, but demand is already high and continues to increase. Where there’s a will, there’s a way.

- Camera Technology Offers Unprecedented Situational Awareness – Camera technology is advancing at an unprecedented rate and has some advantages over Lidar and other ranging sensors in many scenarios – particularly when it comes to reading road signs and identifying the specific nature of potential hazards. Modern processors can handle the necessary image capture rates and fidelity, and thereby enable AI to leverage far more information about the vehicle’s environment into making better decisions.

- Driver-Assistance Features May Facilitate Consumer AV Adoption – While fully automated vehicles are not currently available to the consumer market, there has been an increase of semi-automated “driver assist” functions like cruise control, automatic braking, and self-parking in many cars and trucks on the market. This is likely to increase consumers’ comfort level with the idea of technology driving a vehicle by the time AVs are available to them.

________________________________________________________________________

The Autonomous Driving Industry in China: A Glance at the Regulatory Framework

By Dawn (Dan) Zhang and John Gao

With the evolution of autonomous driving (AD) and the proliferation of more innovative businesses, China’s regulatory agencies have put forward a series of regulations related to various aspects of the AD industry. In general, the Chinese government encourages the application and commercialization of AD technology, as it focuses on AD companies’ regulatory data compliance.

1. Nationwide Competition of Commercialized AD Operation Underway

In July 2021, the newly issued Management Specifications for Road Test and Piloting Application of Intelligent Connected Vehicles introduced for nationwide regulation the “piloting application” of AD vehicles. After completion of the road-testing phase, AD companies may, once approved by local governments, carry passengers and cargos with their AD vehicles on designated roads. Before the new specifications, only a few places, such as Shanghai and Shenzhen, accepted piloting application. In late 2021 and early 2022, more cities published the local version specifications allowing piloting application in municipalities such as Tianjin and Chongqing.

2. Restrictions on Mapping and Surveying Licenses

The development of AD technology depends in large part on mapping and surveying of surroundings. Under Chinese law, mapping and surveying refer to measuring, collecting, and expressing the shape, size, spatial position, and attributes of natural geographical elements or artificial facilities on the surface, as well as processing and providing the acquired data, information, and results. A company must obtain a surveying license before engaging in mapping and surveying. Drawing high-precision maps of the road for road-testing, and accompanying map data collection through censor and LiDAR (light detection and ranging), are typically classified as “navigation electronic map making,” a subcategory of the broader concept of mapping and surveying. Foreign investors are prohibited from investing in companies engaging in navigation and electronic map making, among other subcategories.

3. More Stringent Data and Personal Information Compliance

Vehicle data is now heavily regulated after the Cyberspace Administration of China, along with several other government departments, issued Several Provisions on Automotive Data Security Management (for trial implementation, “Trial Provisions”). Handlers of vehicle data (i.e., personal information about automobile owners, drivers, passengers, pedestrians, and other individuals (PI) and “important data” relating to vehicle design, manufacturing, sales, use, and maintenance) include vehicle manufacturers, spare part manufacturers, software providers, distributors, repair and maintenance agencies, and ride-hailing companies. This list might also include AD companies, if they handle particular vehicle data. On the one hand, the Trial Provisions, an exceptional piece of legislation, generally furnishes handlers with specific guidance on handling PI in the context of the vehicle industry. On the other hand, the Trial Provisions explicitly enumerate “important data” in the vehicle industry, including, among other things, (1) geographic information on military management areas, national defense science, and industry units and important sensitive areas such as the Chinese Community Party and government’s organs including and above the county level, (2) traffic volume, logistics, and other data that reflect economic performance, (3) out-of-vehicle video and image data containing faces, license plates, etc., (4) PI involving more than 100,000 individuals, and (5) other data that the relevant government authorities think might endanger national security, public interest, or the legitimate rights and interests of individuals and organizations. Notably, the draft Trial Provisions included two types of important data – “out-of-vehicle audio data” and “surveying and mapping data whose accuracy is higher than that of the maps publicly released by the state” – which the final Trial Provisions removed without clarification on motive or intention.

Important data is subject to additional protections under the Trial Provisions. For example, important data (1) must be stored in China, (2) can only be exported to countries outside of China after a government-led security assessment is conducted, and (3) must be reported to the Cyberspace Administration of China no later than Dec. 15 of each year. AD enterprises commonly capture out-of-vehicle video information including both facial imagery and license plates in testing and subsequent operation, which by definition constitutes important data under the Trial Provisions. As a result, this information should be stored in China and only exported out of China when appropriate steps are taken. AD enterprises should evaluate their compliance with the Trial Provisions and take measures to fulfill the important data storage and protection obligations and to ensure all such data is being processed and stored within China, in order to avoid compliance risks. Furthermore, they should annually report (by no later than Dec. 15 each year) to the government their processing activities (including export) of important data. Note that the Cyberspace Administration of China received numerous vehicle industry filings at the end of 2021.

In September 2021, the Ministry of Industry and Information Technology (MIIT) via official notification required AD companies to strengthen their cybersecurity and data security compliance. According to MIIT, AD vehicles are deemed an integral part of the internet of vehicles (IOV). IOV platform operators and AD companies should cooperate with one another to safeguard cyber and data security relating to smart connected vehicles.

The revised Measures for Network Security Review (effective Feb. 15, 2022), another significant development in this area, require network platform operators holding more than one million users’ PI to file for network security review if they plan to go public in other countries. The government may in its discretion decide to begin network security review if it believes certain network products/services or data processing activities pose or may affect national security. AD industry stakeholders should take into consideration the possible delay caused by network security review before going public in foreign capital markets, either through IPO or SPAC, etc.

Events & Speaking Engagements

Life Sciences, MedTech & Robotics Networking Event | May 10-11, 2022

Greenberg Traurig, LLP will host investors, executives, and entrepreneurs attending DeviceTalks Boston, Healthcare Robotics Engineering Forum or the Life Sciences Patent Network (LSPN) North America Conference for a casual evening of cocktails and conversation at our Boston office’s roof deck overlooking the city.

DeviceTalks Boston | May 10-11, 2022

Greenberg Traurig Shareholder and Co-Chair of the firm’s Life Sciences & Medical Technology Practice David J. Dykeman will moderate the session “Positioning IP to Preserve Future M&A” on Tuesday, May 10 from 3-3:45 p.m. at DeviceTalks Boston, taking place at the Boston Convention and Exhibition Center May 10 -11, 2022. DeviceTalks is an essential meeting for entrepreneurs, engineers, and other professionals developing the latest tools used to treat patients and cure disease. GT is a DeviceTalks Boston sponsor.

Learn more about DeviceTalks Boston here.

Healthcare Robotics Engineering Forum | May 10-11, 2022

Greenberg Traurig Shareholders Todd C. Basile and Roman Fayerberg will speak at the Healthcare Robotics Engineering Forum at the Boston Convention and Exhibition Center May 10-11, 2022. Their panel, “Attract Investors by Protecting Innovations in Medical Robotics,” will take place Tuesday, May 10 from 2-2:45 p.m. The forum provides engineers, engineering management, and business professionals with informed guidance, peer networking opportunities, and hands-on access to the latest robotics-enabling technologies.

Learn more about the Healthcare Robotics Engineering Forum here.

Energy Drone & Robotics Summit | June 20-22, 2022

Greenberg Traurig Shareholder Todd C. Basile will host a panel with executives from MissionGO, TruWeather Solutions, and Drone Industry Systems Corporation at the Energy Drone & Robotics Summit at The Woodlands Waterway Marriott June 20-22, 2022. Their panel, “The ‘Logistics Labyrinth’: Charting a Path to Scalable Drone Ops,” will explore ways to navigate logistical challenges to improve drone ops and enable automated fleet solutions. The summit is the largest event in the world for UAVs, Robotics, and Data/AI/ML, exclusively focused on the business and technology of unmanned systems, automation, and data in energy and industrial operations.

Learn more about the Energy Drone & Robotics Summit here.

Industrial XR Global Summit │ Oct. 28-30, 2021

|

Todd C. Basile spoke at a fireside chat at the Industrial XR Global Summit in Houston. During the chat, Basile and Ommo Technologies discussed the transformative impact of position-sensing platforms on commercial applications of augmented, virtual, and mixed-reality technologies. |

Energy Drone & Robotics Summit │Oct. 25-27, 2021

|

Todd C. Basile spoke during a fireside chat at the Energy Drone & Robotics Summit in Houston. During the session, Basile and ARIX Technologies discussed the revolutionary impact of autonomous robots on energy infrastructure maintenance with lower costs, enhanced data, and improved safety. |

Massachusetts Medical Device Industry Council (MassMEDIC) Webinar | June 22, 2021

Greenberg Traurig partnered with the Massachusetts Medical Device Industry Council (MassMEDIC) to host the webinar “Robotics IP Strategies for Success.” Greenberg Traurig Shareholder and Life Sciences & Medical Technology Practice Co-Chair David J. Dykeman moderated the panel featuring Greenberg Traurig Shareholders Todd C. Basile and Roman Fayerberg as panelists along with Dr. Partha Mitra, Ph.D., founder & chief scientific advisor at ClaraPath Inc. This presentation offered attendees practical strategies for building a strong patent portfolio, including:

- Business advantages of a strategic IP portfolio

- Patent strategy – offensive and defensive strategies, taking advantage of USPTO accelerated prosecution programs, strategies for foreign filing

- Focusing product development through knowledge of the patent landscape

- Securing ownership in and maintaining control of IP

- IP due diligence – being prepared for the tough questions

Industry Articles

Design patents can provide extra protection for medical robots

Medical Design & Outsourcing │By Todd C. Basile, David J. Dykeman, and Roman Fayerberg

Medical robotics companies often emphasize utility patents when building strategic patent portfolios, given the complex nature of robotics technology. However, don’t overlook design patents, which provide another layer of protection by covering elements of robotics beyond the scope of utility patents.

A robust patent portfolio is an important indicator of a successful medical robotics company. As the medical robotics industry continues to grow and more and more companies enter the increasingly competitive market, a medical robotics company needs a comprehensive and strategic patent portfolio around its technology to compete. A strategic patent portfolio attracts investors, keeps competitors at bay, and provides necessary ammunition in litigation. Read full article.

Tips for Protecting Intellectual Property to Secure Funding

Medical Product Outsourcing │By Todd C. Basile, David J. Dykeman, and Roman Fayerberg

Intellectual property due diligence is a critical step of any acquisition or investment process. In our previous MPO column, we provided tips for preparing for and passing patent due diligence. In addition to patents, medtech companies utilize other types of intellectual property, such as software, data protection, and trade secrets to distinguish themselves from the competition. This column provides tips on how to ensure a medtech company’s other valuable intellectual property is ready for due diligence. Read full article.

Building A Robotics Patent Portfolio to Secure Funding

Medical Product Outsourcing │By Todd C. Basile, David J. Dykeman, and Roman Fayerberg

The medical robotics market continues to grow at unprecedented rates. Between 2012 and 2018, the number of robot-assisted surgeries increased from 1.8 percent to 15.1 percent of all general procedures, and the trend continues. The market for medical robotics is currently valued at about $8 billion and expected to exceed $25 billion by 2025. More funding for medical robotics research and recent IPOs of surgical robotics companies are providing growth capital. Thus, it is not surprising that investments in medical robotics firms helped medical device funding top $5 billion in Q3 2020. Read full article.

Protecting Robotics Innovations: Five Tips From Your Favorite Robots

Robotics Tomorrow │By Todd C. Basile, David J. Dykeman, and Roman Fayerberg

When it comes to starting and building a robotics company, a robust intellectual property protection strategy can be the driving force behind market share, strategic collaborations, and capital investments.

We touched base with five of your favorite robots for insights into their success. Every robotics company should consider these tips for protecting and leveraging its innovations. Read full article.

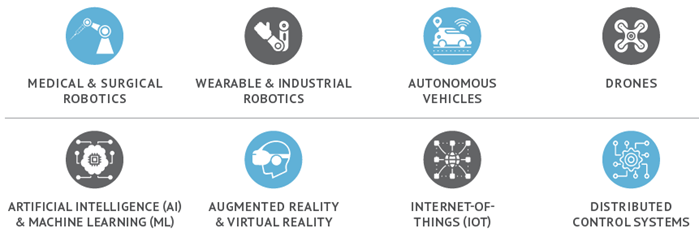

About the GT Robotics & Autonomous Technologies Practice

Greenberg Traurig’s multidisciplinary team provides strategic legal guidance to help clients develop, fund, and bring to market today’s innovations and those just around the corner. We advise clients ranging from startups to multinational public companies and research institutions, as well as investors, venture capital, and private equity funds.